Tapcheck Raises $225 Million to Revolutionize Payday Access for America’s Workforce

In a groundbreaking move set to redefine how workers access their earnings, Tapcheck, a leader in on-demand pay solutions, has announced the successful raise of $225 million in combined equity and debt financing. This funding round includes a $25 million Series A extension led by existing investor PeakSpan Capital and a $200 million credit facility provided by Victory Park Capital. The infusion of capital underscores Tapcheck’s mission to empower employees nationwide by providing seamless access to earned wages ahead of traditional pay schedules, alleviating financial stress and fostering workplace satisfaction.

A Vision Born from Financial Empathy

Founded in 2019 by entrepreneurial husband-and-wife team Ron and Kayling Gaver, Tapcheck emerged from a shared vision to address the financial challenges caused by rigid pay cycles. Traditional pay schedules often leave workers struggling paycheck-to-paycheck, creating unnecessary financial pressure. Tapcheck’s innovative platform enables employees to access their earned wages when they need them most—before payday—offering greater financial flexibility while improving morale, retention, and productivity.

“We’re thrilled to have the continued support of PeakSpan Capital and the strategic backing of Victory Park Capital,” said Ron Gaver, co-founder and CEO of Tapcheck. “This infusion of capital will further strengthen our capacity to empower employees nationwide and alleviate financial pressure by granting access to earned wages ahead of traditional pay schedules.”

How Tapcheck Works: Seamlessly Integrating with Payroll Systems

Tapcheck’s on-demand pay platform seamlessly integrates with nearly 300 payroll and timekeeping systems, offering a smooth, accurate, and cost-effective solution for employers and employees alike. Unlike other financial services that impose hidden fees, Tapcheck provides a transparent and responsible way for employees to access their hard-earned wages.

Employers using Tapcheck report significant benefits, including over 50% improvement in employee retention. Meanwhile, employees note that the service reduces financial stress, with 70% reporting a positive impact on their financial well-being. By positioning itself as a free tool for employers, Tapcheck ensures widespread adoption without adding operational burdens or costs.

Milestones and Impact Across Industries

Since its inception, Tapcheck has facilitated over $1 billion in early wage funding and served 12,000 employer locations, establishing itself as a trusted name in the earned wage access (EWA) space. The company’s proprietary wage calculation engine ensures exceptional accuracy, enhancing transparency and boosting employee engagement. With an ‘Excellent’ Trustpilot rating, Tapcheck is recognized globally as one of the most reliable EWA providers, supported by increasing usage rates and glowing feedback from both employers and employees.

Tapcheck has partnered with major brands such as Hilton, Planet Fitness, Taco Bell, and Jiffy Lube, achieving remarkable milestones across industries. Notably, the platform has seen significant adoption in the quick-service restaurant (QSR) sector, serving 112,000 McDonald’s employees and enabling over $160 million in advance wage disbursements. Additionally, hundreds of thousands of frontline caregivers in skilled nursing, home health, and rehabilitation sectors have benefited from Tapcheck’s services, underscoring its versatility and impact.

Investor Confidence and Strategic Growth

The latest funding round reflects strong investor confidence in Tapcheck’s leadership, model, and mission.

“We are fired up to embark on this next chapter alongside Tapcheck,” said Jack Freeman, partner at PeakSpan Capital. “Over the last three years, we’ve witnessed Ron and Kayling assemble a world-class team, build game-changing products, and amplify reach by growing over 20x. They’ve done so while tripling down on user experience, payroll accuracy, integrations, and onboarding—Tapcheck’s standout strengths, enabling the business to drive maximum value to the end-user wage worker.”

Similarly, Jason Brown, senior partner at Victory Park Capital, praised Tapcheck’s innovative approach: “Tapcheck is setting a new standard for how employees access and manage their earnings. By addressing real financial needs while driving retention and performance for employers, Tapcheck is delivering measurable value—and we have strong confidence in the company’s leadership, model, and mission.”

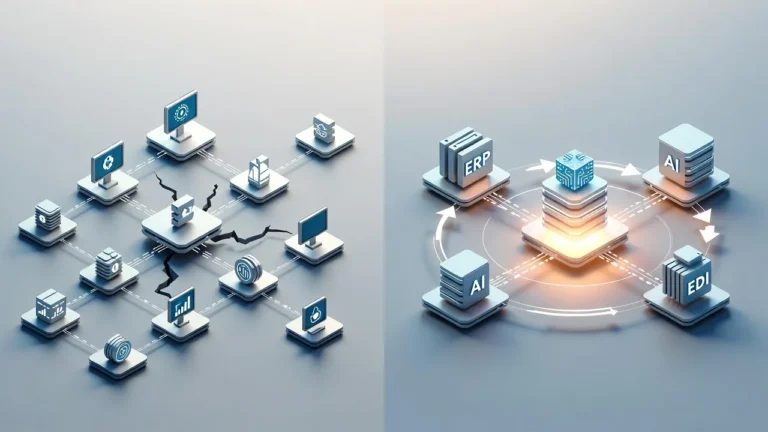

Expanding Horizons: New Products and AI Capabilities

The $225 million funding will fuel Tapcheck’s continued growth and innovation. Key initiatives include:

- Development of New Products: Tapcheck is working on a next-generation product designed to give millions of employees early access to their wages, further solidifying its position as a leader in the EWA space.

- Enhanced Mastercard Offering: The company plans to improve accessibility and functionality of its Tapcheck Mastercard, empowering users with more flexible payment options.

- AI-Powered Advancements: Tapcheck aims to accelerate the expansion of its AI capabilities, leveraging cutting-edge technology to enhance payroll accuracy, streamline integrations, and optimize user experiences.

These advancements align with Tapcheck’s broader goal of becoming a cornerstone of the next generation of earned wage access solutions, ensuring that employees and employers alike benefit from its innovative platform.

Why Tapcheck Matters: Transforming Financial Wellness

Tapcheck’s mission extends beyond convenience—it’s about transforming financial wellness for America’s workforce. For too long, traditional pay cycles have left workers vulnerable to financial instability. By providing on-demand access to earned wages, Tapcheck empowers employees to take control of their finances, avoid predatory lending practices, and reduce stress associated with paycheck-to-paycheck living.

For employers, Tapcheck offers a powerful tool to boost retention, engagement, and productivity. As the workforce evolves, companies that prioritize employee financial wellness will gain a competitive edge—and Tapcheck is leading the charge.

A Bright Future for Earned Wage Access

With $225 million in fresh funding, Tapcheck is poised to expand its reach, refine its offerings, and continue revolutionizing the way employees access their earnings. By addressing real financial needs while delivering measurable value to employers, Tapcheck is not only redefining payday but also shaping the future of work.

As the demand for earned wage access grows, Tapcheck’s commitment to security, compliance, and user-centric innovation positions it as a trailblazer in the industry. With a proven track record, visionary leadership, and robust financial backing, Tapcheck is ready to scale its impact and bring financial empowerment to millions of workers across the nation.