CIMB Bank Partners with ACI Worldwide to Drive Payment Transformation and Future-Proof Operations

In a strategic move to bolster resilience, enhance customer-centric innovation, and align with global payment standards, CIMB Bank, one of ASEAN’s leading banking groups and Malaysia’s second-largest financial services provider, has partnered with ACI Worldwide (NASDAQ: ACIW). This collaboration marks a significant milestone in CIMB’s Forward30 strategic plan, which aims to future-proof operations, accelerate digital convergence, and deliver seamless, secure, and intelligent payment experiences for both consumers and businesses.

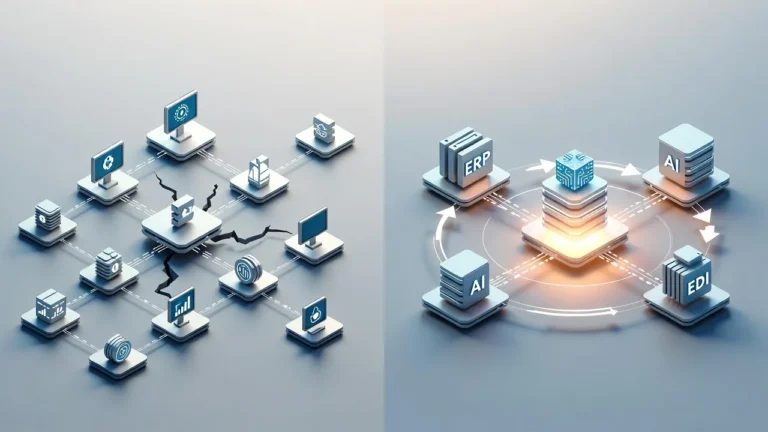

A Unified Platform for Modern Payments

At the heart of this transformation is ACI’s cutting-edge payment solution, designed to converge all account-to-account transactions—real-time, Automated Clearing House (ACH), Real-Time Gross Settlement (RTGS), and cross-border payments—onto a single, future-proof platform. This ISO 20022-native compliant platform serves as the foundation for CIMB Group’s regional payments infrastructure, starting from its headquarters in Malaysia. By adopting ISO 20022, a global standard for richer data exchange, CIMB is enhancing interoperability, security, and compliance while enabling straight-through processing and actionable insights.

The new unified solution addresses the challenges posed by siloed legacy systems, which often lead to inefficiencies, higher costs, and increased risks. With this modernized platform, CIMB Bank will achieve greater operational efficiency, agility, and scalability while minimizing costs and mitigating risks. The transition to a single, enterprise-wide system reflects CIMB’s commitment to staying ahead of evolving customer expectations and regulatory mandates.

CIMB’s Bold Step Toward Next-Generation Banking

According to Ros Aziah, Group Chief Technology Officer at CIMB Bank, “CIMB’s payment transformation is a bold re-architecture of our core payments infrastructure to unify all payment flows. This enterprise-wide initiative is a cornerstone of our Forward30 Strategy, built to future-proof operations, accelerate digital convergence, and deliver seamless, secure, and intelligent payment experiences for both consumers and businesses. Aligned with ISO 20022 and powered by our partnership with ACI Worldwide, CIMB is positioning itself at the forefront of next-generation banking.”

This forward-thinking approach underscores CIMB’s dedication to leveraging technology to drive innovation and meet the demands of a rapidly changing financial landscape. By consolidating payment operations onto a single platform, CIMB is not only streamlining its processes but also empowering its customers with faster, more reliable, and data-rich payment experiences.

Industry Recognition for Innovation and Collaboration

The collaboration between CIMB Bank and ACI Worldwide has already garnered industry recognition. The two organizations were recently honored at The Asian Banker (TAB) Global Financial Technology Innovation Awards 2025 in the “Best Corporate Banking and Payment Technology Initiative in Asia Pacific” category. In its evaluation, TAB praised the technological differentiation and customer-centric approach demonstrated by CIMB and ACI Worldwide, highlighting how the project enhances security, scalability, and performance while ensuring the bank remains adaptable to rising customer expectations and evolving regulatory requirements.

“ACI is proud to be the strategic partner behind CIMB’s full-scale payment transformation—a complex, end-to-end overhaul that unified CIMB’s payment operations across real-time, high-value, low-value, and cross-border transactions onto a modern, enterprise-wide ISO 20022 platform—and we are honored that our successful partnership has been recognized with a prestigious industry award,” said Leslie Choo, Senior Vice President and Managing Director – APAC, ACI Worldwide. “This partnership is a testament to how forward-thinking banks like CIMB can lead in a digital-first economy in Malaysia and across ASEAN.”

ACI Worldwide: A Proven Leader in Payments Technology

With over 50 years of experience, ACI Worldwide has established itself as a trusted innovator in global payments technology. The company currently powers 26 domestic and pan-regional real-time payment schemes across six continents, including 11 central infrastructures. Notably, ACI played a pivotal role in introducing Malaysia’s Real-time Retail Payments Platform (RPP) in collaboration with PayNet, the national payments network and central infrastructure provider.

Globally, ACI serves all 10 of the world’s largest financial institutions by asset value and processes trillions of dollars through more than one billion transactions daily. This extensive expertise positions ACI as a leader in enabling real-time, secure, and scalable payment solutions for banks and financial institutions worldwide.

Driving Digital Convergence and Customer-Centric Innovation

CIMB’s partnership with ACI Worldwide exemplifies the growing importance of digital convergence in the banking sector. As consumer behavior shifts toward digital-first interactions, financial institutions must adopt innovative technologies to remain competitive. The new payment platform not only enhances operational efficiency but also enables CIMB to deliver personalized, data-driven services that meet the needs of modern customers.

By embracing ISO 20022 and leveraging ACI’s advanced solutions, CIMB is well-positioned to lead in the era of next-generation banking. The platform’s scalability ensures that CIMB can adapt quickly to emerging trends, such as the rise of cross-border e-commerce, real-time payments, and AI-driven financial services.

A Strategic Move for ASEAN Leadership

As CIMB expands its footprint across ASEAN, this partnership reinforces its commitment to delivering smarter, more inclusive financial services. By modernizing its payment infrastructure, CIMB is setting a benchmark for other financial institutions in the region, demonstrating how strategic investments in technology can drive growth, enhance customer satisfaction, and ensure long-term sustainability.

For CIMB, this collaboration with ACI Worldwide represents more than just a technological upgrade—it’s a bold step toward becoming a leader in the digital-first economy. With a unified, future-proof platform, CIMB is poised to deliver unparalleled value to its customers while maintaining its position at the forefront of innovation in the financial services industry.