Insight Enterprises Repurchases $76 Million in Common Stock from ValueAct Capital: A Strategic Move to Enhance Shareholder Value

Insight Enterprises, Inc. (Nasdaq: NSIT), a leading technology solutions provider, has announced a significant stock repurchase agreement with ValueAct Capital Master Fund, L.P. Under the terms of the agreement, Insight will acquire 600,000 shares of its common stock at a price of approximately $126.86 per share, amounting to a total value of $76 million. This transaction is part of Insight’s ongoing $300 million stock repurchase program, underscoring the company’s commitment to optimizing its capital structure and delivering value to shareholders.

Strengthening Capital Structure and Shareholder Returns

The decision to repurchase shares reflects Insight’s strategic focus on enhancing shareholder value while maintaining financial flexibility. In a statement, Joyce Mullen, President and Chief Executive Officer of Insight Enterprises, emphasized the importance of this move. “Today’s announcement reinforces our goal to optimize our capital structure and our business, while also creating substantial value for our shareholders,” she said. “This also represents another step in our continuing relationship with ValueAct Capital that began in 2021.”

By repurchasing shares, Insight reduces the number of outstanding shares in the market, which can lead to an increase in earnings per share (EPS) and potentially boost the stock price. Such measures are often viewed positively by investors, as they signal confidence in the company’s future growth prospects.

A Testament to Collaboration with ValueAct Capital

ValueAct Capital, a prominent investment firm known for its active engagement with portfolio companies, expressed its support for the transaction. Alex Baum, a partner at ValueAct Capital, stated, “This transaction is a testament to our continued close engagement with the Insight team. The sale of our shares back to the company enables ValueAct Capital to both help accelerate the capital return to shareholders and proportionally size our ownership stake for our revised role as an advisor to Insight during its transformation into the leading AI Solutions Integrator.”

The collaboration between Insight and ValueAct Capital dates back to 2021, when the two entities began working together to drive operational improvements and strategic growth initiatives. This latest transaction highlights the alignment between the company’s leadership and its key stakeholders, demonstrating a shared vision for long-term success.

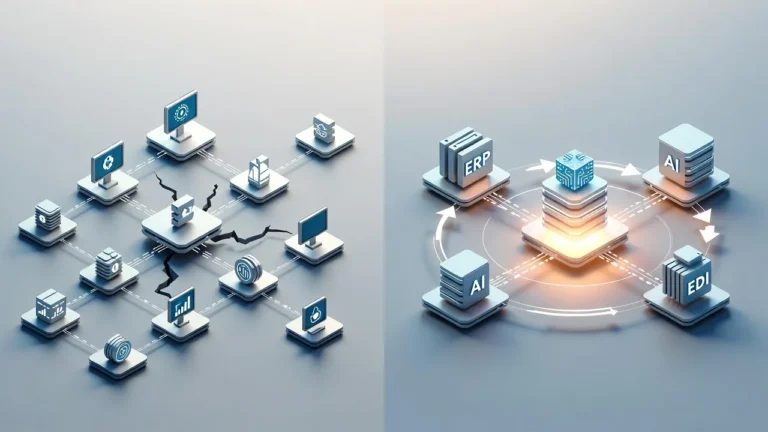

Insight’s Transformation into an AI Solutions Leader

As businesses increasingly adopt artificial intelligence (AI) technologies, Insight Enterprises is positioning itself as a leader in the AI solutions integration space. The company’s efforts to streamline its operations and enhance its product offerings align with the growing demand for innovative IT solutions. By leveraging its expertise in cloud computing, data analytics, and cybersecurity, Insight aims to deliver cutting-edge services that empower organizations to harness the full potential of AI.

The stock repurchase agreement with ValueAct Capital is not just a financial maneuver—it’s a strategic step forward in Insight’s journey toward becoming a dominant player in the AI solutions market. With reduced share dilution and a stronger balance sheet, the company is well-positioned to invest in research and development, expand its customer base, and explore new market opportunities.

Compliance and Legal Considerations

It’s important to note that this news release does not constitute an offer to sell or a solicitation of any offer to buy securities in any state or jurisdiction. Additionally, no sale of Insight’s securities will occur in any state or jurisdiction where such an offer, solicitation, or sale would be unlawful prior to registration or qualification under applicable securities laws. Insight’s securities may only be offered or sold in the United States if registered under the Securities Act of 1933, as amended, or if an exemption from registration requirements is available.

Any public offering of Insight’s securities in the U.S. will be made exclusively through a registration statement filed with and declared effective by the Securities and Exchange Commission (SEC). Investors and stakeholders are encouraged to review all relevant filings and disclosures to stay informed about the company’s activities and compliance with regulatory requirements.