Zocks and Commonwealth Partner to Revolutionize Advisor Efficiency with AI-Powered Client Intelligence

In an exciting development for the financial advisory industry, Zocks, a cutting-edge, privacy-first AI platform that transforms client conversations into actionable insights, has partnered with Commonwealth Financial Network (“Commonwealth”), a leading national RIA committed to empowering financial advisors with integrated business solutions. This collaboration marks a significant step forward in enhancing advisor efficiency while maintaining a strong focus on client-centric service delivery.

The partnership includes the launch of Zocks’ enterprise platform, specifically tailored to meet Commonwealth’s elevated standards for advisor experience and compliance requirements. By leveraging Zocks’ innovative technology, Commonwealth aims to streamline workflows, improve client interactions, and provide advisors with tools that drive measurable results across its network.

Why Zocks Was Chosen as Commonwealth’s Exclusive Partner

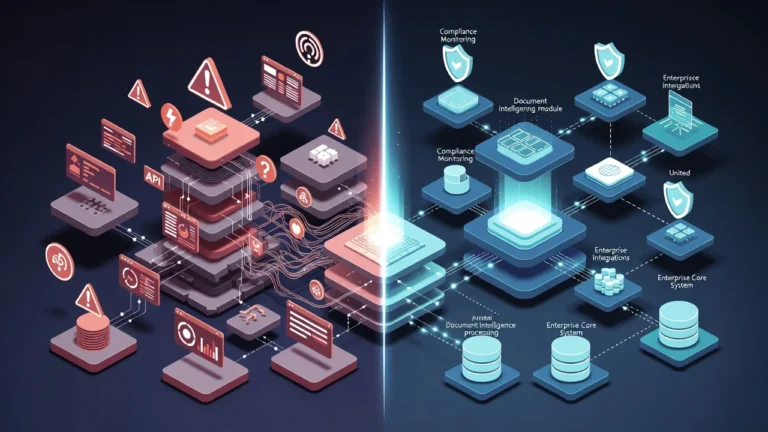

When evaluating potential partners to enhance advisor productivity, Commonwealth found Zocks to be the ideal match. The platform stood out due to its advisor-specific design, accuracy in capturing detailed data, and robust capabilities for accelerating pre- and post-meeting workflows. Additionally, Zocks’ enterprise-grade user management and compliance controls aligned perfectly with Commonwealth’s commitment to maintaining high standards of security and regulatory adherence.

“Zocks was built from the ground up to meet the real-world needs of busy financial advisors,” said Mark Gilbert, CEO of Zocks. “We’re proud to partner with Commonwealth to equip their advisors with a tailored solution that streamlines workflows, enhances client service, and drives meaningful results across its community.”

How Zocks Enhances Advisor Productivity and Client Service

One of the key features that impressed Commonwealth is Zocks’ intuitive user experience and customizable templates. These templates allow advisors to prioritize meeting outcomes effectively, ensuring that every client interaction is purposeful and productive. Furthermore, Zocks’ ability to sync tasks directly to client and household records within CRM systems significantly reduces manual data entry, saving time and minimizing errors. This seamless integration strengthens continuity across client interactions, enabling advisors to deliver consistent, high-quality service.

“As we explored how generative AI could meaningfully support advisor productivity, Zocks quickly emerged as the clear choice,” said Chris Blotto, SVP and Chief Digital & Information Officer at Commonwealth. “The platform was purpose-built for independent advisory firms, with enterprise controls and compliance embedded at its core from day one. Its ability to integrate seamlessly with our existing technology stack makes it not just a tactical solution but a strategic enabler of how we scale indispensable service across our advisor community.”

A Strategic Move Toward Scalable, Client-Centric Solutions

This partnership underscores Commonwealth’s dedication to scaling advisor efficiency without compromising its client-centric approach. In today’s fast-paced financial landscape, advisors face increasing demands on their time and resources. By adopting Zocks’ AI-powered platform, Commonwealth is equipping its advisors with tools that automate routine tasks, freeing them to focus on building deeper relationships with clients and delivering personalized advice.

Moreover, the implementation of Zocks’ technology reflects Commonwealth’s forward-thinking strategy to embrace innovation responsibly. With advanced compliance controls baked into the platform, advisors can confidently adopt these new tools knowing they align with regulatory requirements and safeguard sensitive client information.

The Future of AI in Financial Advisory Services

The collaboration between Zocks and Commonwealth highlights the growing role of artificial intelligence in transforming financial advisory services. As more firms recognize the value of AI-driven insights, platforms like Zocks are becoming essential for staying competitive in an evolving marketplace. By combining human expertise with machine learning capabilities, advisors can elevate their performance and offer unparalleled value to clients.

For Commonwealth, this partnership represents more than just a technological upgrade—it’s a strategic investment in the future of its advisor network. By integrating Zocks’ platform into their operations, Commonwealth is positioning itself as a leader in leveraging AI to enhance both advisor productivity and client satisfaction.

Empowering Advisors Through Innovation

The partnership between Zocks and Commonwealth is set to redefine how financial advisors operate, making their workflows more efficient and their client interactions more impactful. With Zocks’ AI-powered platform at their fingertips, Commonwealth’s advisors will be better equipped to navigate the complexities of modern financial planning while delivering exceptional service to their clients.

As the financial advisory industry continues to evolve, collaborations like this demonstrate the power of innovation to drive positive change. For Commonwealth and its affiliated advisors, the integration of Zocks’ technology signals a bold step toward a future where technology and human expertise work hand-in-hand to create lasting value for clients.

By choosing Zocks as its exclusive partner, Commonwealth has solidified its position as a trailblazer in the industry, paving the way for other firms to follow suit. Together, Zocks and Commonwealth are setting a new standard for what’s possible when cutting-edge technology meets a steadfast commitment to client success.