The Arena Group Proves Resilience with Entrepreneurial Publishing Model, Posts $6.9 Million Net Income and Expands Data, IP, and E-Commerce Efforts

The Arena Group Holdings, Inc. (NYSE American: AREN), a leading brand, data, and intellectual property (IP) company, has demonstrated the strength of its entrepreneurial publishing model by delivering another profitable quarter. Home to iconic brands such as Parade, TheStreet, Men’s Journal, Athlon Sports, ShopHQ, and the Adventure Network (including Surfer, Powder, and Bike Magazine), The Arena Group reported strong financial results for the three months ending September 30, 2025 (“Q3 2025”). These results underscore the company’s ability to adapt to industry challenges while expanding its revenue streams through data, IP, and e-commerce initiatives.

Financial Highlights for Q3 2025

The Arena Group achieved impressive financial performance in Q3 2025, driven by its diversified revenue model and disciplined cost management:

- Revenue: Quarterly revenue totaled $29.8 million, compared to $33.6 million in Q3 2024. It is worth noting that Q3 2024 included a one-time $3 million licensing agreement that boosted net income.

- Net Income: Net income surged to $6.9 million, a 73% increase from $4.0 million in Q3 2024.

- Margins: Net margin improved to 23.2%, up from 11.9% in Q3 2024, while Adjusted EBITDA margin rose to 39.9%, compared to 33.3% in the prior year period.

- Adjusted EBITDA: Adjusted EBITDA grew by 6.3% year-over-year, reaching $11.9 million in Q3 2025, compared to $11.2 million in Q3 2024.

- Earnings Per Share (EPS): Trailing twelve-month (TTM) income from continuing operations amounted to $30.5 million, translating to EPS of $0.64 based on 47.6 million shares outstanding as of September 30, 2025. This represents a price-to-earnings ratio of over 7.0x based on the share price of $4.87 at the NYSE American Market close on November 10.

- Debt Reduction and Cash Position: The company reduced its net leverage below 2x after making $10 million in principal payments year-to-date, fully paying off its revolving credit facility. Additionally, The Arena Group amassed a robust cash balance of $12.5 million.

Paul Edmondson, CEO of The Arena Group, commented on the results: “Despite persistent audience volatility across the industry, we delivered another highly profitable quarter. Our diversified model and variable cost structure continue to prove resilient, allowing us to drive margin expansion, generate cash, and grow net income even when traffic fluctuates. Profitability is no longer episodic—it’s becoming consistent and repeatable.”

Operational Highlights for Q3 2025

The Arena Group’s operational achievements in Q3 2025 reflect its strategic focus on diversifying revenue streams and leveraging its portfolio of brands to create new opportunities for growth:

Sports & Leisure

The company’s Sports & Leisure division showcased significant progress in audience and revenue diversification. Non-advertising revenue for brands like Athlon Sports and Men’s Journal grew nearly 200% year-over-year, primarily driven by off-property distribution and syndication efforts. This growth highlights the effectiveness of The Arena Group’s strategy to monetize content beyond traditional advertising.

TheStreet

TheStreet, The Arena Group’s financial brand, experienced a 20% increase in on-site traffic compared to Q3 2024. Additionally, revenue from content syndication efforts soared by 200% during the same period, demonstrating the brand’s ability to expand its reach and capitalize on its expertise in financial journalism.

Parade

The lifestyle brand Parade also delivered strong results, with traffic increasing by 25% compared to Q3 2024. Non-advertising revenue, including performance marketing and syndication efforts, more than doubled year-over-year, growing by 111%. This underscores the brand’s success in diversifying its monetization strategies.

Commerce Content Growth

Total pageviews to commerce content surged by 82% in Q3 2025 compared to Q3 2024, reflecting growing consumer engagement with The Arena Group’s e-commerce offerings. This growth aligns with the company’s broader strategy to integrate commerce into its content ecosystem.

Strategic Acquisitions and Expansion

In October 2025, The Arena Group executed its disciplined M&A strategy by acquiring the digital assets and IP of two properties: ShopHQ and Lindy’s Sports. Funded entirely with cash on hand, these acquisitions enhance the company’s e-commerce and sports portfolios, deepen its brand ecosystem, and unlock new monetization opportunities.

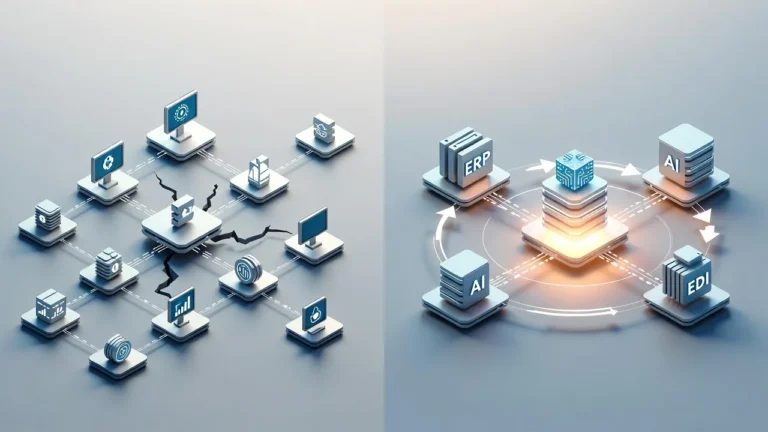

“These acquisitions are a testament to our commitment to scaling efficiently,” said Edmondson. “We’re extending our entrepreneurial publishing model into video and social selling/commerce while accelerating our evolution into a data, AI, and e-commerce-driven business.”

About The Arena Group

The Arena Group Holdings, Inc (NYSE American: AREN) is a brand, data and IP company that builds, acquires and scales high-performing digital assets. We combine technology, storytelling and entrepreneurship to create deep content verticals that engage passionate audiences across sports & leisure, lifestyle and finance. Through our portfolio of owned and operated brands including Parade, TheStreet, Men’s Journal, Athlon Sports, ShopHQ and the Adventure Network (Surfer, Powder, Bike Magazine and more), we deliver trusted content and meaningful experiences to millions of users each month. Visit us at thearenagroup.net to learn more.