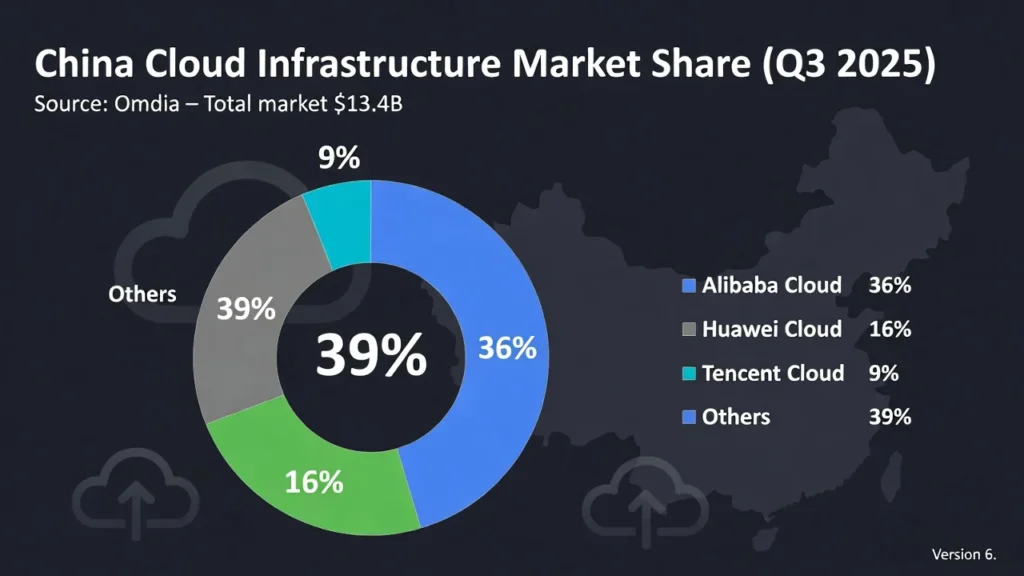

Mainland China Reaches $13.4B in Q3 2025 as Alibaba, Huawei, and Tencent Prioritize Agent Platforms Over Model Benchmarks

China’s cloud infrastructure services market reached $13.4 billion in Q3 2025, marking 24% year-over-year growth—the second consecutive quarter exceeding 20% expansion. This acceleration signals a fundamental shift: enterprises are moving beyond early-stage AI experimentation toward production deployments that generate sustained demand for compute, storage, and database services. According to Omdia, the growth trajectory reflects AI’s evolution from isolated proof-of-concept projects to integrated platform components that require systematic orchestration of models, data, tools, and workflows at scale.

Market leadership remained concentrated, with Alibaba Cloud capturing 36% share, Huawei Cloud holding 16%, and Tencent Cloud accounting for 9%. However, the competitive dynamics are changing. As foundation model capabilities plateau relative to enterprise requirements, leading providers are shifting focus from model performance leaderboards to platform-level reliability, operational stability, and agent development toolchains that enable commercialization.

From Model Capability to Platform Integration: Why AI Demand Patterns Are Changing

For the past two years, cloud providers competed primarily on foundation model benchmarks—which model scored highest on reasoning tasks, which achieved best-in-class multimodal understanding, which delivered superior language generation. These metrics mattered when enterprises were evaluating AI potential, but they’re insufficient for production deployments where reliability, integration complexity, and total cost of ownership determine success.

“As AI adoption deepens, leading cloud vendors are complementing ongoing improvements in foundation model capabilities by positioning these models as functional components within a broader platform stack,” said Rachel Brindley, Senior Director at Omdia. “Clearer role definition and tighter platform integration are becoming an increasing focus.”

This shift manifests in how providers structure their AI portfolios. Alibaba Cloud expanded its multimodal model lineup, releasing nine Qwen3-VL models strengthening video understanding and spatial perception, followed by the Wan2.6 video generation series—including China’s first reference-to-video generation model. Huawei Cloud accelerated AI adoption through industry-specific models, co-launching the Tianji Predictive Model 1.0 with China Southern Airlines for aviation and manufacturing applications. Tencent Cloud introduced HY 2.0 Think and Instruct models, differentiating complex reasoning capabilities from agent workflow execution.

These aren’t incremental model updates. They reflect strategic repositioning of AI from general-purpose foundation models toward specialized tools with defined roles within enterprise workflows.

Key Insights at a Glance

- Market scale: Q3 2025 revenue of $13.4B, representing 24% YoY growth—second consecutive quarter above 20% expansion

- Market concentration: Alibaba Cloud 36% share, Huawei Cloud 16%, Tencent Cloud 9%; partner-driven revenue reached 25% of market

- Growth driver shift: AI workloads transitioning from experimentation to production, generating spillover demand across core infrastructure services

- Platform convergence: All three leaders advanced AI agent development platforms with systematic upgrades to MCPs (Model Context Protocols), workflows, knowledge bases, and plugin frameworks

- Alibaba Cloud momentum: Triple-digit AI revenue growth for nine consecutive quarters; strategic partnerships with Marriott, GAC Group, L’Oréal China, Haier

Agent Platforms Emerge as the New Competitive Battleground

The most significant development in H2 2025 was the convergence of leading cloud providers around AI agent platform strategies. Alibaba Cloud, Huawei Cloud, and Tencent Cloud all advanced their agent development platforms beyond capability demonstration toward engineering-led, operationally scalable infrastructure. These upgrades focused on Model Context Protocols (MCPs), workflow orchestration, knowledge base integration, and plugin frameworks—the technical foundation required to move agents from demos to production systems.

“Individual model performance alone is no longer sufficient to meet enterprise needs in real-world use cases,” said Yi Zhang, Senior Analyst at Omdia. “The central challenge in scaling AI initiatives lies in orchestrating models, data, tools, and workflows within complex systems in a way that enables reuse, operationalization, and commercialization.”

Alibaba Cloud launched AgentRun in December, a serverless-based service designed specifically for production-grade AI agent deployment and operation. Huawei Cloud upgraded its agent development platform in October, adding over 80 official prebuilt MCP tools to strengthen orchestration capabilities. Tencent Cloud enhanced its Agent Development Platform (ADP) with upgraded MCP plugins, workflow management, and knowledge systems, while announcing commercial billing for RAG-based models within its platform—marking a transition from experimental offerings to revenue-generating services.

This simultaneous focus on agent infrastructure isn’t coincidental. As enterprises deploy AI across business processes, they require systems that coordinate multiple models, access enterprise data securely, integrate with existing tools, and maintain governance controls—capabilities that individual models can’t provide regardless of benchmark performance.

Infrastructure Expansion and Ecosystem Leverage

While AI platform development dominated strategic initiatives, providers continued geographic expansion. Alibaba Cloud brought its second Dubai data center online in October, extending Middle East capacity. Huawei Cloud announced its Ireland region’s third availability zone will launch in early 2026, supporting European cloud and AI demand growth.

Partner-driven cloud revenue represented 25% of the market in Q3, with Omdia expecting this share to grow as ecosystem collaboration becomes essential for translating AI adoption into business value. This trend reflects a reality enterprises are discovering: successful AI deployment requires domain expertise, integration services, and change management that cloud providers alone can’t deliver.

Tencent Cloud’s experience illustrates the resource constraints shaping competition. Growth remained limited by advanced AI computing resource availability, forcing the company to balance customer-facing AI delivery with internal application development and product iteration—a constraint competitors likely face but acknowledge less publicly.

As China’s cloud market enters 2026, the question isn’t whether AI will drive continued growth. The Q3 results confirm sustained demand. The question is whether current platform investments—agent toolchains, workflow orchestration, production-grade deployment infrastructure—actually reduce the complexity enterprises face moving from AI experiments to scaled business impact. Partner revenue share and agent platform commercialization metrics will provide the answer.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.