Strategic Initiative Combines Engineering Services, Supply Chain Stability, and Software Expertise for Software-Defined Vehicle Transition

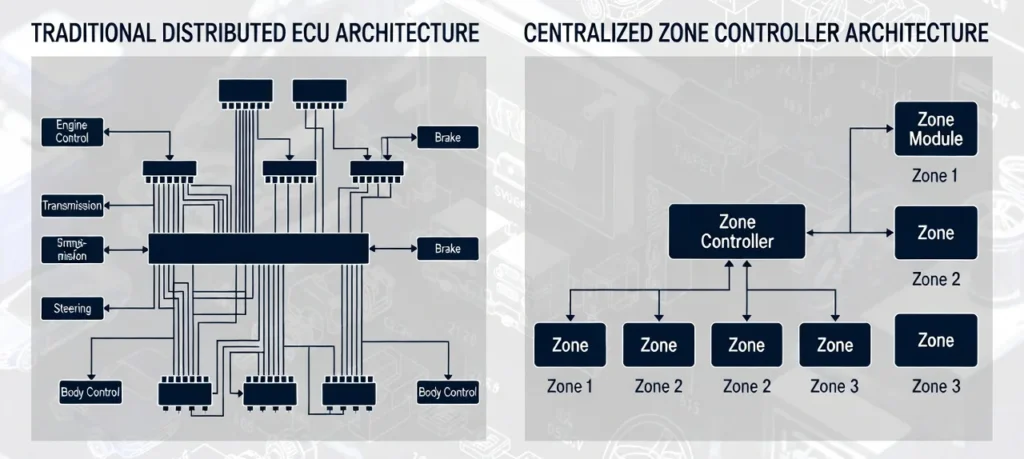

The automotive industry is dismantling an architecture that defined vehicle design for decades. For years, adding a new electronic feature—adaptive cruise control, lane-keeping assist, infotainment upgrades—meant adding another dedicated electronic control unit (ECU). Modern vehicles accumulated hundreds of these specialized computers, each with its own wiring harness, creating complexity that undermined reliability, increased weight, and made over-the-air updates nearly impossible. Arrow Electronics has launched a strategic initiative and research hub to help automotive manufacturers and tier-1 suppliers navigate the replacement of this distributed model with centralized electrical and electronic (E/E) architecture that treats vehicles as software-defined platforms rather than hardware assemblies.

The initiative positions Arrow as what the company calls a “solution aggregator,” bridging individual component sourcing with integrated system design. This includes engineering services spanning semiconductors and IP&E (interconnect, passive, and electromechanical) components, global inventory management, supply chain resilience planning, and expanded software capabilities in AUTOSAR, functional safety, and automotive cybersecurity.

Why Hundreds of ECUs Can’t Scale to Software-Defined Vehicles

Traditional automotive E/E architecture evolved incrementally. When manufacturers added anti-lock braking systems, they installed a dedicated ECU. When they introduced power windows, another ECU. Climate control, engine management, airbag systems—each function received its own computing node. This distributed approach worked when electronics were optional features, but it breaks down when vehicles become intelligent platforms requiring constant software updates, real-time sensor fusion, and coordinated decision-making across systems.

The consequences are tangible. Excessive wiring adds weight, reducing range in electric vehicles where every kilogram matters. Point-to-point connections create failure modes that cascade unpredictably. Software updates require physical recalls because systems can’t be reprogrammed remotely. Most critically, the architecture can’t support the computational demands of advanced driver assistance systems (ADAS) and autonomous driving, which require centralized processing of data from cameras, radar, lidar, and vehicle sensors simultaneously.

Next-generation E/E architecture consolidates these hundreds of distributed ECUs into a smaller number of powerful computing hubs—often called zone controllers or domain controllers—that manage multiple functions. This redesign can reduce internal wiring by up to 20%, creating vehicles that are lighter, more energy-efficient, and capable of receiving over-the-air updates throughout their lifecycle.

Key Insights at a Glance

- Architectural transformation: Shift from hundreds of individual ECUs to centralized computing hubs managing multiple vehicle functions

- Weight and efficiency gains: Internal wiring reduction of up to 20%, improving energy efficiency critical for EV range optimization

- Arrow’s service integration: Engineering support across semiconductors and IP&E components, global inventory, supply chain resilience, and automotive software expertise

- Software portfolio expansion: AUTOSAR implementation, functional safety standards compliance, and automotive cybersecurity capabilities following 2024 acquisitions of iQMine and Avelabs

- Resource availability: Dedicated research hub offering technical insights, whitepapers, and design tools for E/E architecture development

From Component Distributor to System Integration Partner

Arrow’s initiative reflects how distributor roles are evolving in automotive supply chains. When vehicles were primarily mechanical systems with discrete electronic add-ons, distributors focused on component availability and pricing. As vehicles become software platforms where hardware, firmware, and application layers must integrate seamlessly, customers need partners who understand cross-domain dependencies—how power management choices affect thermal constraints, how communication protocols impact cybersecurity postures, how component obsolescence planning aligns with 10-15 year vehicle lifecycles.

“E/E architecture is the cornerstone of the modern automotive revolution, enabling the transition from hardware-centric machines to intelligent, software-defined mobility,” said Murdoch Fitzgerald, Arrow’s chief growth officer of global services for the global components business. “By combining our global engineering reach with a broad range of components and specialized software expertise, we are well positioned to help our customers navigate this complexity, reducing their time-to-market and helping ensure their platforms are built to adapt as the industry evolves.”

The 2024 acquisitions of iQMine and Avelabs signal Arrow’s recognition that hardware expertise alone doesn’t address the challenge. AUTOSAR—the standardized software architecture used across automotive manufacturers—requires specialized implementation knowledge. Functional safety standards like ISO 26262 demand rigorous validation processes. Automotive cybersecurity introduces threat models that don’t exist in consumer electronics. These capabilities don’t naturally reside in traditional distribution organizations, requiring deliberate buildout through acquisition and talent development.

Supply Chain Stability in a Redesigned Architecture

Redesigning E/E architecture introduces supply chain vulnerabilities that traditional automotive procurement teams may underestimate. Centralizing computing creates single points of failure—if a domain controller becomes unavailable, entire vehicle functions go dark. This shifts obsolescence planning from managing hundreds of low-complexity ECUs to managing a smaller number of high-complexity computing platforms where component lifecycles must align with vehicle production timelines spanning years.

Arrow’s multisourced, traceable component strategies and proactive obsolescence planning address these risks by identifying alternative suppliers before shortages materialize and flagging end-of-life notices that could strand vehicle platforms mid-production. For manufacturers launching new vehicle architectures in 2026-2028, these planning horizons determine whether they can sustain production through 2035-2040 without costly mid-lifecycle redesigns.

The research hub Arrow launched provides technical insights and design tools aimed at engineers and procurement leaders managing this transition. As the automotive industry moves from incremental feature additions to comprehensive platform redesigns, the organizations that succeed won’t just source components—they’ll orchestrate complex technical and supply chain dependencies across domains that previously operated independently.

About Arrow Electronics

Arrow Electronics (NYSE:ARW) sources and engineers technology solutions for thousands of leading manufacturers and service providers. With 2025 sales of $31 billion, Arrow’s portfolio enables technology across major industries and markets. Learn more at arrow.com.