E2open to Be Acquired by WiseTech Global: A Strategic Move to Transform Supply Chain Solutions

In a groundbreaking development for the supply chain and logistics industries, E2open Parent Holdings, Inc. (NYSE: ETWO), a leading provider of connected supply chain SaaS platforms, has announced its acquisition by WiseTech Global Limited (ASX: WTC). This definitive agreement marks the culmination of E2open’s strategic review process, positioning the company for long-term growth while delivering significant value to shareholders.

Under the terms of the transaction, E2open stockholders will receive $3.30 per share in cash, valuing the enterprise at an impressive $2.1 billion. The per-share purchase price represents a premium of approximately 28% over the company’s closing stock price on May 23, 2025, and a staggering 68% premium over the closing price on April 30, 2025, prior to media reports about WiseTech’s interest in acquiring E2open. This substantial premium underscores the strategic importance of E2open’s platform and its potential to enhance WiseTech’s global footprint.

A Strategic Partnership to Drive Innovation

The acquisition brings together two industry leaders with complementary capabilities. E2open’s multi-enterprise network and advanced supply chain solutions are renowned for their ability to streamline operations across complex global supply chains. WiseTech Global, a pioneer in logistics execution software, shares E2open’s commitment to innovation and operational excellence. Together, they aim to create a leading end-to-end platform that empowers businesses to navigate the challenges of modern supply chain management.

Andrew Appel, Chief Executive Officer of E2open, expressed confidence in the deal, stating, “After a comprehensive strategic review conducted by our Board and Rothschild & Co, we believe this agreement with WiseTech Global maximizes value for our shareholders and positions the Company for long-term success. WiseTech’s global reach and dedication to innovation align perfectly with E2open’s strengths. By combining our expertise, we can deliver unparalleled solutions for the world’s most complex supply chains.”

Chinh E. Chu, Chairman of the Board of Directors of E2open, echoed this sentiment, emphasizing the company’s focus on core business fundamentals throughout the strategic review process. “This outcome not only delivers significant value for our shareholders but also highlights the strength of E2open’s solution portfolio and client base,” he said.

Transaction Details and Next Steps

Following the announcement, both companies have confirmed that they will continue to operate independently until the transaction closes, which is expected in the second half of calendar year 2025. The deal is subject to customary closing conditions, including regulatory approvals. Notably, shareholders holding a majority of the voting power of E2open’s issued and outstanding shares have already approved the transaction by written consent, eliminating the need for further shareholder votes.

Once the transaction is complete, E2open’s common stock will no longer be listed on the New York Stock Exchange, marking the end of its tenure as a publicly traded company. However, this move is anticipated to unlock new opportunities for growth and innovation under WiseTech’s leadership.

Why This Acquisition Matters for the Industry

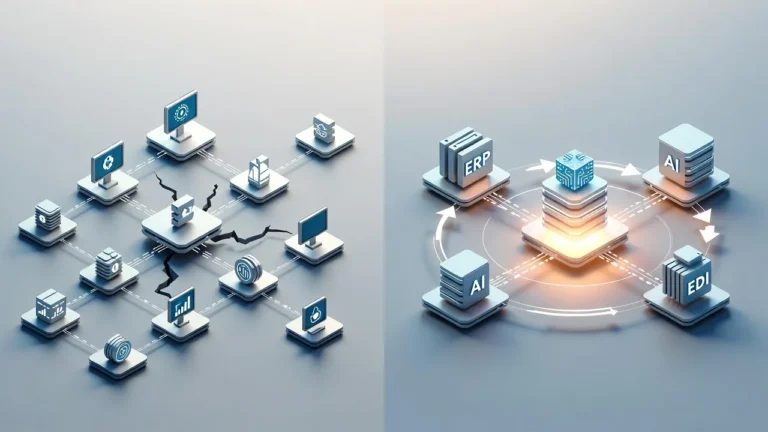

The acquisition of E2open by WiseTech Global is more than just a financial transaction—it represents a transformative moment for the supply chain and logistics sectors. As global supply chains grow increasingly complex, businesses require robust, integrated solutions to manage operations efficiently. By merging E2open’s multi-enterprise network with WiseTech’s logistics execution capabilities, the combined entity will offer a comprehensive suite of tools designed to address these challenges head-on.

For E2open’s clients, this partnership promises enhanced functionality, expanded global reach, and access to cutting-edge technologies. Meanwhile, WiseTech’s existing customer base stands to benefit from E2open’s proven expertise in multi-enterprise collaboration and supply chain visibility.

A Win-Win for Shareholders and Stakeholders

From a financial perspective, the acquisition delivers exceptional value to E2open shareholders. The $3.30 per share cash offer reflects a significant premium, rewarding investors for their trust in the company’s vision and growth potential. Moreover, the deal ensures continuity for E2open’s employees, clients, and partners, who will continue to benefit from the company’s innovative solutions.

For WiseTech, the acquisition reinforces its position as a leader in the logistics technology space. By integrating E2open’s capabilities into its portfolio, WiseTech is poised to expand its market presence and accelerate its growth trajectory.

About e2open

E2open is the connected supply chain software platform that enables the world’s largest companies to transform the way they make, move, and sell goods and services. With the broadest cloud-native global platform purpose-built for modern supply chains, e2open connects more than 500,000 manufacturing, logistics, channel, and distribution partners as one multi-enterprise network tracking over 18 billion transactions annually. Our SaaS platform anticipates disruptions and opportunities to help companies improve efficiency, reduce waste, and operate sustainably. Moving as one.™ Learn More: www.e2open.com.