Domain Growth Signals Continued Digital Expansion Across Enterprise and SMB Sectors

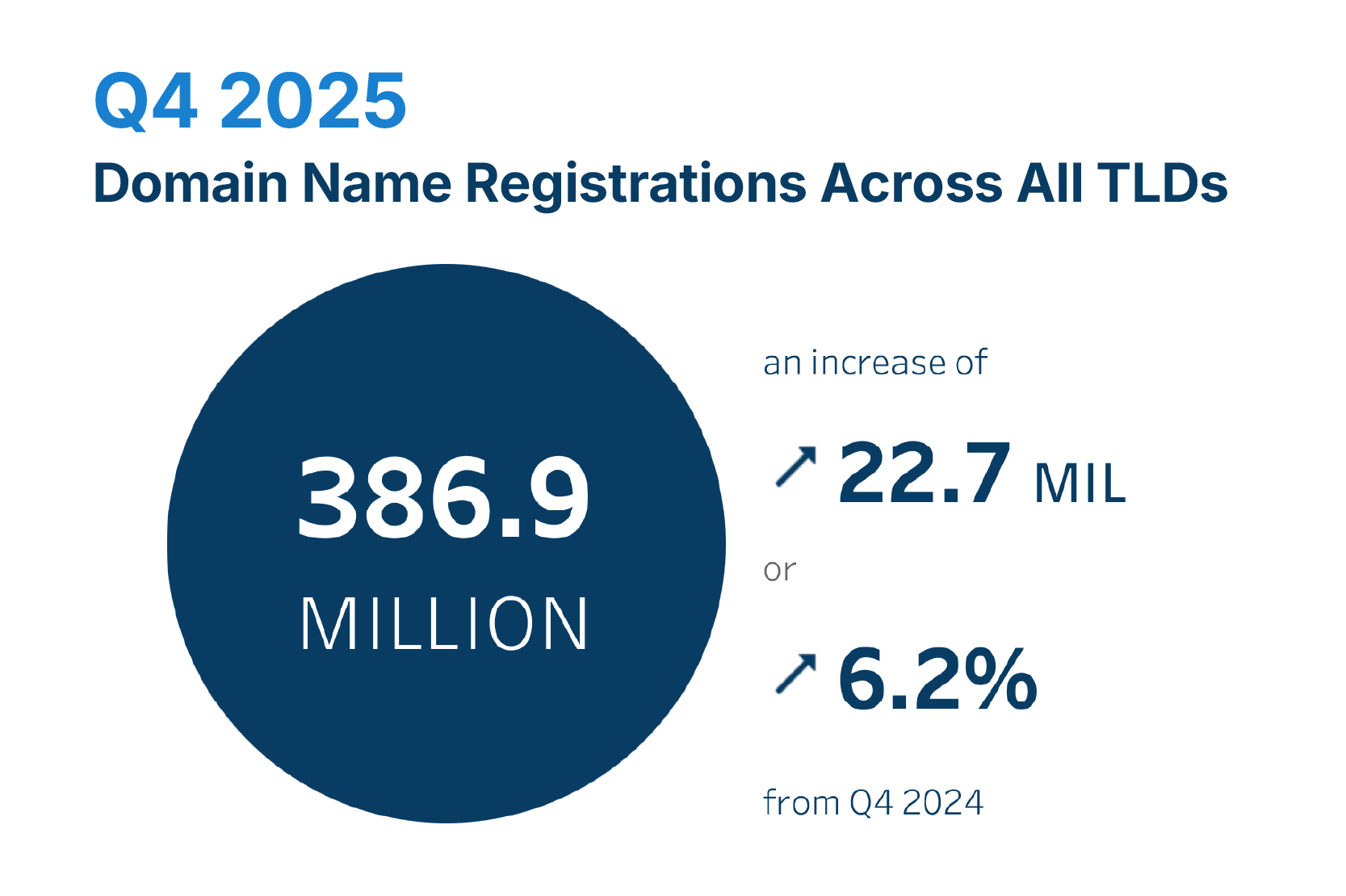

The internet’s foundational layer—domain name registrations—continues its upward trajectory, reflecting sustained digital transformation investments across industries. According to the latest Domain Name Industry Brief (DNIB) Quarterly Report, global domain name registrations across all top-level domains (TLDs) reached 386.9 million at the close of Q4 2025, marking a 2.2% quarter-over-quarter increase (8.4 million new registrations) and a robust 6.2% year-over-year growth (22.7 million additions).

For B2B decision-makers tracking digital infrastructure trends, these figures underscore a critical question: What’s driving this persistent expansion, and how should your organization position itself in an increasingly domain-saturated marketplace?

Breaking Down the Numbers: .com, .net, and ccTLD Performance

The Legacy Giants Hold Strong

The combined .com and .net TLD base totaled 173.5 million registrations by year-end 2025, up 0.9% from Q3 and 2.6% year-over-year. The .com domain alone accounted for 161.0 million registrations, while .net captured 12.5 million. Notably, new .com and .net registrations climbed to 10.7 million in Q4 2025—a 12.6% increase compared to 9.5 million in Q4 2024. This uptick in new registrations suggests both organic market expansion and heightened competition for premium digital real estate.

Country-Code TLDs Demonstrate Geographic Digital Maturity

Country-code TLDs (ccTLDs)—such as .cn (China), .de (Germany), and .uk (United Kingdom)—reached 145.6 million registrations, posting a 3.4% annual growth rate. While quarter-over-quarter growth remained modest at 0.6%, the year-over-year gain of 4.8 million registrations signals localized digital strategies gaining traction, particularly in emerging markets like India (.in) and Brazil (.br), both ranking in the top 10 ccTLDs globally.

What This Means for B2B Organizations and Digital Strategy

1. Domain Portfolio as a Strategic Asset

For enterprises managing multi-brand portfolios or expanding into new markets, defensive domain registrations and localized ccTLD acquisitions are no longer optional—they’re table stakes. The 6.2% annual growth rate outpaces many traditional infrastructure investment categories, positioning domain strategy as both brand protection and revenue enabler.

2. Increased Competition for Namespace

With 10.7 million new .com/.net registrations in Q4 alone, businesses face tighter competition for memorable, SEO-friendly domain names. Organizations delaying digital presence expansions—whether for product launches, regional campaigns, or M&A brand integrations—risk higher acquisition costs or forced compromises on domain quality.

3. Signal of Broader Digital Investment

Domain registration growth often precedes or parallels increased spending in web infrastructure, cloud services, and digital marketing. IT leaders and CMOs should view these metrics as a leading indicator: competitors are doubling down on digital touchpoints, and customer acquisition channels are diversifying.

Key Insights at a Glance

- Total global domain registrations: 386.9 million (Q4 2025), up 6.2% YoY

- .com/.net combined base: 173.5 million, with 10.7 million new registrations in Q4

- ccTLD growth: 145.6 million total, led by .cn, .de, .uk, .ru, .nl

- Quarter-over-quarter momentum: 8.4 million new registrations (+2.2%)

- Implication: Accelerated digital presence expansion across enterprise and SMB sectors globally

Looking Ahead: Domain Strategy in a Generative AI Era

As generative AI tools increasingly surface direct answers and synthesize web content, owning authoritative, keyword-aligned domains becomes even more critical for brand visibility. How might your organization’s domain architecture perform when AI systems curate sources for users? The growing namespace—and the rush to secure it—suggests forward-thinking teams are already asking that question.

For organizations evaluating digital infrastructure roadmaps, these DNIB figures offer a clear message: the foundation of the internet is expanding, and strategic domain management deserves a seat at the executive table.

About DNIB.com

DNIB.com, sponsored by Verisign, provides global statistical and analytical research and data on the domain name industry, plus analyses of key policy, security, and technology trends. The latest Domain Name Industry Brief Quarterly Report, previous reports, and interactive dashboards with expanded domain name industry data are all available at DNIB.com.

About Verisign

Verisign (NASDAQ: VRSN), a global provider of critical internet infrastructure and domain name registry services, enables internet navigation for many of the world’s most recognized domain names. Verisign helps enable the security, stability, and resiliency of the Domain Name System and the internet by providing root zone maintainer services, operating two of the 13 global internet root servers, and providing registration services and authoritative resolution for the .com and .net top-level domains, which support the majority of global e-commerce. To learn more please visit verisign.com.