Microsmart and Begini Partner to Revolutionize Microfinance Access for Greek MSMEs

In a groundbreaking move to empower Greece’s micro, small, and medium-sized enterprises (MSMEs), Microsmart SA, the country’s first decentralized microfinance institution, has partnered with Begini, a leading alternative data fintech company. This collaboration aims to provide fast, fair, and accessible financing solutions to underserved entrepreneurs across Greece. With MSMEs representing 99% of all Greek businesses, this partnership marks a pivotal step in closing the credit gap that has long hindered the growth of small businesses.

Bridging the Credit Gap for Underserved Entrepreneurs

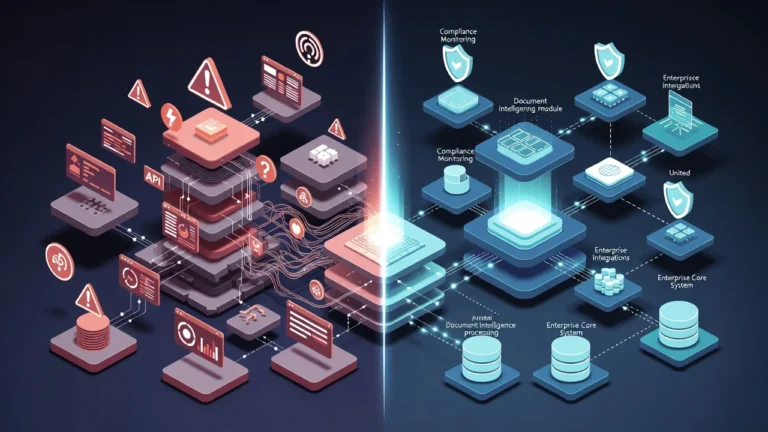

Traditional banks have historically struggled to serve Greece’s smallest businesses, often due to a lack of formal credit history or insufficient financial records. Recognizing this challenge, Microsmart SA sought innovative tools to extend credit responsibly to these underserved entrepreneurs. Backed by national regulators, Microsmart turned to Begini’s cutting-edge psychometric credit assessment technology to transform its lending process.

The integration of Begini’s solution into Microsmart’s digital lending flow was seamless, taking just two working days to deploy. This groundbreaking tool generates predictive first-party credit data without requiring applicants to provide financial or personal records, making it an ideal solution for entrepreneurs who have been excluded from traditional banking systems.

Impressive Results: Boosting Lending Volumes and Accessibility

Since implementing Begini’s technology six months ago, Microsmart has reported remarkable results. Monthly lending volumes surged by 90%, while the completion rate for loan applications reached an impressive <95%. These figures underscore both the high demand for accessible financing and the effectiveness of the new system in removing barriers to credit.

“Microcredit is a modern development tool,” said Neoklis Stamkos, CEO of Microsmart SA. “Our work with Begini helps remove long-standing barriers to finance by combining speed with fair risk assessment. We are proud to help entrepreneurs across Greece turn their ambitions into action, without the friction of traditional banking.”

This partnership not only addresses the immediate need for accessible financing but also sets a new standard for inclusive lending practices in Greece and beyond.

How Begini’s Psychometric Credit Assessment Works

At the core of this partnership is Begini’s psychometric credit assessment technology, which leverages behavioral insights to evaluate creditworthiness. Unlike traditional credit scoring methods that rely on financial records, Begini’s solution analyzes patterns in applicant behavior, such as decision-making tendencies and financial habits, to predict repayment likelihood.

This approach ensures that even borrowers without a formal credit history can access the funding they need to grow their businesses. By focusing on human-centered metrics, Begini’s technology promotes financial inclusion while maintaining robust risk management standards.

“Microsmart’s leadership in microfinance made them the ideal partner for our alternative credit technology,” said James Hume, CEO of Begini. “Together, we’re proving that simple, behavioral insights can drive financial inclusion at scale—safely, affordably, and in days, not months.”

A Digital-First Approach to Financial Inclusion

As Greece continues to rebuild and grow its small business sector following economic challenges, the partnership between Microsmart and Begini demonstrates the transformative potential of digital-first, human-centered credit solutions. By leveraging technology to streamline the lending process, this collaboration is delivering real-world outcomes for underserved communities.

For Greek entrepreneurs, the benefits are clear: faster access to capital, reduced administrative burdens, and fairer assessment criteria. These advantages enable MSMEs to focus on what truly matters—growing their businesses and contributing to the local economy.

Why This Partnership Matters for Greece’s Economy

MSMEs are the backbone of Greece’s economy, accounting for the vast majority of businesses and employing a significant portion of the workforce. However, limited access to financing has historically stifled their growth potential. By addressing this issue head-on, Microsmart and Begini are playing a crucial role in fostering economic recovery and resilience.

The success of this partnership serves as a model for other countries grappling with similar challenges. By combining innovative technology with a commitment to inclusivity, Microsmart and Begini are proving that financial inclusion is not only achievable but scalable.

Looking Ahead: A Brighter Future for Greek Entrepreneurs

The collaboration between Microsmart and Begini represents more than just a technological advancement—it’s a testament to the power of innovation in driving social and economic progress. As Greece’s small business sector continues to evolve, this partnership ensures that entrepreneurs have the tools they need to thrive.

For Neoklis Stamkos, the mission is clear: “We are committed to helping Greek entrepreneurs overcome the barriers that have held them back for too long. With Begini’s support, we are building a future where access to finance is no longer a privilege but a right.”

Join the Movement Toward Financial Inclusion

If you’re passionate about supporting small businesses and promoting financial inclusion, this partnership offers valuable insights into how technology can drive meaningful change. By leveraging alternative data and digital solutions, Microsmart and Begini are paving the way for a more equitable financial ecosystem.

To learn more about how Microsmart and Begini are transforming the landscape of microfinance in Greece, stay tuned for updates and explore their innovative offerings. Together, they are proving that with the right tools and vision, it’s possible to create a brighter, more inclusive future for entrepreneurs everywhere.