Omdia Forecasts Strong Growth for PC Gaming Handhelds, with 2.3 Million Units Expected in 2025

New research from Omdia reveals that the global market for PC gaming handhelds is set to grow significantly, with 2.3 million units expected to be sold in 2025. This represents a 32% increase from 2024, during which 1.7 million units were sold. Furthermore, Omdia predicts that annual sales of PC gaming handhelds will reach 4.7 million units by 2029, signaling sustained growth and increasing consumer interest in this emerging category.

Devices like the Valve Steam Deck have already established a foothold in the market, but challenges remain for PC vendors looking to capitalize on this trend. According to James McWhirter, Senior Analyst covering games at Omdia, “Windows 11 is currently poorly suited to handheld gaming, and devices are not delivering a generational leap in performance over the market-leading Steam Deck.” These limitations have hindered broader adoption beyond the core audience of PC gaming enthusiasts.

However, 2025 is shaping up to be a pivotal year for the industry, as key advancements address these pain points. Microsoft’s upcoming refreshed gaming mode for Windows 11 is expected to dramatically enhance the user experience on PC gaming handhelds. Additionally, the launch of the first Xbox-branded handhelds in late 2025 could expand the appeal of these devices to a wider audience, including casual gamers and console players.

Microsoft’s recent partnership with AMD is another promising development. The collaboration aims to provide PC vendors with access to semi-custom APUs (Accelerated Processing Units), which could deliver the much-needed generational leap in performance. This innovation has the potential to level the playing field and make PC gaming handhelds more competitive against established players like the Nintendo Switch.

A Complementary Role in the Gaming Ecosystem

PC gaming handhelds are not replacing traditional desktops or laptops; instead, they coexist as complementary devices. Similarly, Sony’s PlayStation Portal has carved out its own niche within the handheld gaming landscape. According to Omdia’s analysis, the PlayStation Portal achieved a 3% attach rate to PlayStation 5 consoles by the end of 2024. While modest, this indicates growing consumer interest in portable gaming solutions that integrate seamlessly with existing ecosystems.

The arrival of the Nintendo Switch 2 in 2025 marks a new chapter for the handheld gaming market. Nintendo continues to leverage its traditional console model, pairing exclusive blockbuster content with hardware upgrades to drive sales. However, McWhirter notes, “Nintendo continues to follow the traditional console model with the Switch 2 – compelling exclusive blockbuster content marketed in tandem with the hardware. But it will not reach the heights achieved by the original Switch.”

The original Switch’s unique selling point—high-quality gaming on the go—has now been commoditized by competitors. As a result, the Switch 2’s upgrade cycle presents an opportunity for rival platform holders and vendors to attract Switch users to alternative handhelds, such as PC gaming devices or other portable consoles.

Omdia forecasts that over 20 million combined units of the Switch 2 and the original Switch will be sold globally in 2025. While this underscores Nintendo’s enduring popularity, it also highlights the intense competition in the handheld gaming space. Competitors are increasingly targeting the same audience, leveraging innovations in hardware and software to differentiate their offerings.

Broader Market Dynamics and Future Outlook

Omdia’s Games Handhelds Database provides a comprehensive overview of the handheld gaming market, forecasting hardware sales volume, value, and installed base through 2029 across key territories. The database covers a wide range of devices, including the PlayStation Portal, Valve Steam Deck, Nintendo Switch, Switch 2, Asus ROG Ally, Lenovo Legion Go, MSI Claw, Panic Playdate, and others. This breadth of coverage underscores the diversity and dynamism of the handheld gaming ecosystem.

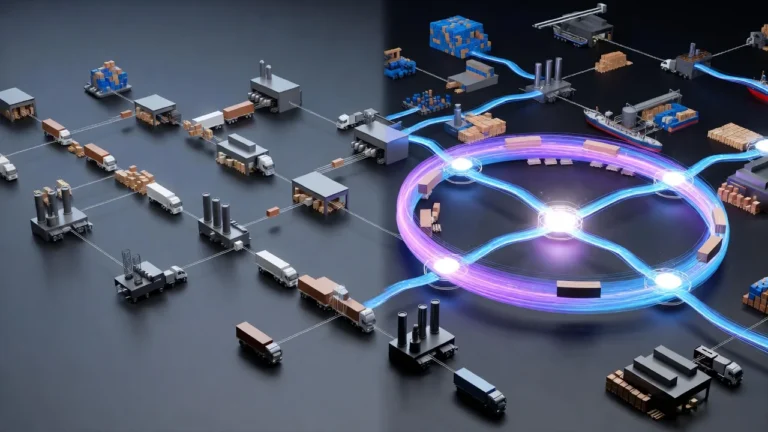

The rise of PC gaming handhelds reflects broader trends in the gaming industry, such as the growing demand for portability, flexibility, and high-performance gaming experiences. These devices cater to gamers who want the power of a PC in a compact, portable form factor. Meanwhile, advancements in cloud gaming and streaming technologies are further blurring the lines between traditional consoles, PCs, and handhelds.

Despite the optimism surrounding PC gaming handhelds, success in this space will depend on overcoming current limitations. Improving operating system compatibility, enhancing performance, and expanding the library of optimized games will be critical for driving mainstream adoption. The entry of Xbox-branded handhelds and the potential impact of Microsoft’s semi-custom APUs could serve as catalysts for change, making 2025 a turning point for the industry.

Opportunities for Growth and Innovation

As the market evolves, there are significant opportunities for growth and innovation. For PC vendors, the challenge lies in differentiating their products while addressing the needs of a diverse audience. Casual gamers, hardcore enthusiasts, and even console players represent distinct segments with varying expectations. By refining user experiences, expanding game libraries, and leveraging partnerships with hardware manufacturers, vendors can position themselves for long-term success.

At the same time, the competition from Nintendo and Sony remains fierce. The Switch 2’s launch will test the resilience of PC gaming handhelds, particularly among consumers loyal to Nintendo’s ecosystem. However, the commoditization of portable gaming means that no single player dominates the market entirely. Instead, the focus shifts to delivering value, performance, and unique features that resonate with gamers.