Perfios Launches AI-Powered Mortgage Solution “Switch” at Dubai FinTech Summit 2025, Onboards Lion Mortgage as First Customer

In a landmark announcement at the Dubai FinTech Summit 2025, Perfios, a global leader in B2B SaaS TechFin solutions, unveiled its latest innovation: Switch, an AI-powered platform designed to revolutionize mortgage operational excellence. This groundbreaking solution aims to streamline and automate the mortgage lifecycle, empowering all stakeholders in the ecosystem—brokers, developers, valuers, and banks—while delivering a frictionless experience for clients.

To mark the occasion, Perfios also announced that Lion Mortgage, a leading mortgage broker in the UAE, has become the first customer to adopt the Switch platform. This milestone underscores Perfios’ growing influence in the region and highlights the trust placed in its cutting-edge technology by industry leaders.

The Need for Transformation in Mortgage Operations

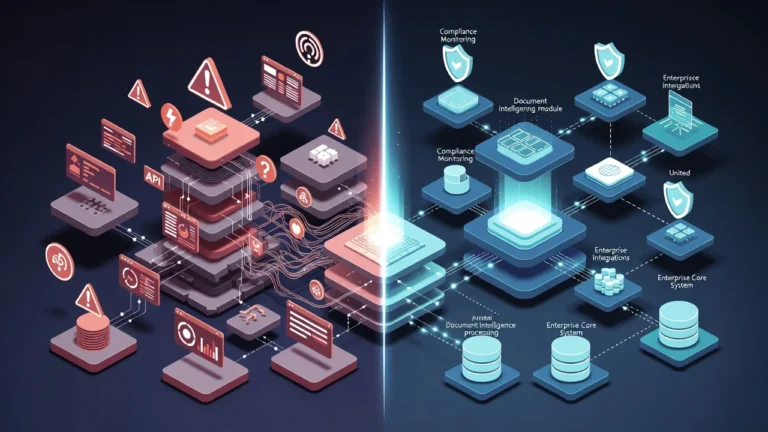

The mortgage industry has long been plagued by inefficiencies, manual processes, and fragmented systems that hinder productivity and client satisfaction. Traditional workflows often lead to delays, errors, and inconsistent decision-making, creating frustration for both service providers and customers.

Recognizing these challenges, Perfios developed Switch to address the persistent pain points in the mortgage journey. Built on the company’s proven Credit Gateway and Nexus 360 technologies, Switch is an out-of-the-box, independent platform that leverages artificial intelligence to deliver smarter, faster, and more transparent mortgage operations.

Key Features of Switch: Empowering Mortgage Stakeholders

Switch offers a comprehensive suite of features designed to transform every stage of the mortgage process:

- Automated Lead Management: Streamlines lead capture, tracking, and nurturing, ensuring no opportunity is missed.

- AI-Based Mortgage Proposal Generation: Analyzes client profiles to create tailored mortgage proposals, improving accuracy and personalization.

- Automated Forms Generation: Eliminates manual paperwork by generating forms automatically based on client inputs.

- Eligibility Calculations and Decision Engine: Provides real-time eligibility assessments and intelligent decision-making to expedite approvals.

- Real-Time Updates and Reporting: Offers stakeholders instant visibility into application statuses and performance metrics.

- Integrated Solutions for Compliance and Analysis: Includes tools for bank statement analysis, KYC verification, credit scoring, and regulatory compliance, ensuring adherence to local laws.

These features collectively enable mortgage brokers, banks, and other stakeholders to operate with unprecedented efficiency and precision.

A Strategic Partnership with Lion Mortgage

The partnership between Perfios and Lion Mortgage marks a significant step forward in redefining mortgage operations in the UAE. As the first adopter of Switch, Lion Mortgage has already experienced transformative results during the trial phase over the past three months.

According to Gaurav Gambhir, Managing Director of Lion Mortgage, “Switch has empowered us to deliver measurable value-driven outcomes. Our clients now enjoy a superior experience thanks to enhanced service delivery, reduced error rates, and faster turnaround times. Additionally, we’ve seen a 25% increase in business volumes and a notable boost in team productivity. By embracing this AI-driven platform, we’re taking a strategic leap toward setting new standards for mortgage services in the UAE.”

This collaboration not only strengthens Perfios’ relationship with key players in the banking sector but also extends its reach to mortgage brokers and other intermediaries, further solidifying its position as a trusted partner in financial technology.

Perfios’ Vision for Operational Excellence

Speaking at the unveiling ceremony, Pramod Veturi, International CEO of Perfios, emphasized the platform’s potential to reshape the mortgage landscape: “Switch is a thoughtfully engineered solution that brings intelligence, speed, and transparency to the mortgage process. Its AI-driven architecture enables smarter decision-making and operational efficiency for banks, brokers, and network partners. We are thrilled to welcome Lion Mortgage as our first customer and look forward to scaling this solution across the UAE and beyond.”

With over 1,000 financial institutions served across 19 countries, Perfios has consistently demonstrated its ability to drive global financial inclusion through innovative technologies. From real-time credit decisioning and analytics to onboarding automation and monitoring, the company continues to empower financial institutions worldwide.

The launch of Switch in the UAE reflects Perfios’ commitment to enhancing operational excellence in the region. With its scalable architecture and robust compliance framework, the platform is poised to adapt seamlessly to diverse markets while adhering to local regulations.

Why Switch Matters for the Future of Mortgages

As the demand for seamless digital experiences grows, the mortgage industry must evolve to meet modern expectations. Switch addresses this need by combining automation, AI, and integration-ready design to create a unified platform that benefits all stakeholders.

For mortgage brokers like Lion Mortgage, Switch reduces operational overheads, minimizes errors, and enhances client satisfaction. For banks and developers, it ensures faster processing times, better risk management, and improved transparency. Ultimately, clients benefit from quicker approvals, personalized offerings, and a smoother overall experience.

By launching Switch at the Dubai FinTech Summit 2025, Perfios has positioned itself at the forefront of financial innovation. The event serves as a global stage for showcasing how technology can drive progress in the financial sector, making it the perfect venue for introducing such a transformative solution.

About Lion Mortgage:

Lion Mortgage is a leading independent mortgage solutions provider based in Dubai. Established in 2013 by seasoned bankers, each bringing over 20 years of experience from top-tier financial institutions, the firm has helped over 8,000 UAE residents and international clients secure home financing with confidence.

With a client-first philosophy and deep market expertise, Lion Mortgage delivers tailored mortgage advisory services that simplify the financing process, ensuring clarity, compliance, and peace of mind. The company is driven by a commitment to long-term financial wellbeing, consistently delivering exceptional client and partner experiences, operational excellence, and performance all enabled by smart, forward-thinking technology.