Rain Raises $75 Million in Series B Funding Led by Prosus to Revolutionize Earned Wage Access for Millions of U.S. Workers

In a significant step toward transforming financial wellness for American workers, Rain, the leading employer-integrated earned wage access (EWA) and financial wellness app, has announced a $75 million Series B funding round. The round was led by Prosus, with additional participation from Nextalia Ventures, Spark Growth Ventures, and existing investors such as QED, Invus Opportunities, and others. This latest funding brings Rain closer to its mission of providing millions of workers with instant access to their earned wages and empowering them with comprehensive financial tools.

Since its founding in 2019, Rain has consistently demonstrated high growth, enabling over 2.5 million workers across diverse industries to access their earnings after every shift. With this new capital infusion, Rain is poised to scale its go-to-market strategy, develop innovative employee financial wellness solutions, and expand its suite of employer-focused tools.

Addressing the Paycheck-to-Paycheck Crisis

Over 70% of American households live paycheck to paycheck, with many struggling to manage immediate financial obligations due to traditional pay cycles that often delay access to earned wages. This gap leaves workers vulnerable to predatory financial products such as overdraft fees, payday loans, and high-interest credit cards, which can trap them in cycles of debt.

Rain addresses this critical issue by partnering with thousands of employers to provide on-demand access to earned wages in a safe and responsible manner. Through multiple free options, Rain empowers workers to take control of their finances, reducing stress and helping them avoid costly alternatives. To date, Rain has saved workers hundreds of millions of dollars by eliminating reliance on predatory financial services.

Seamless Integration and Employer Benefits

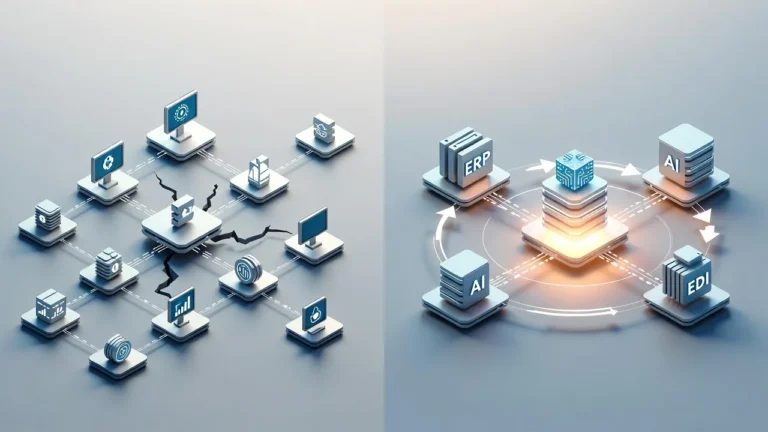

Rain’s platform integrates seamlessly with nearly every major payroll and timekeeping system in the United States, making it effortless for employers to implement and for employees to use. These integrations ensure a fast, reliable user experience while reducing the operational burden on HR and payroll teams.

“Rain is building the employee engagement app of the future, centered around financial wellness,” said Alex Bradford, Co-Founder and CEO of Rain. “We make it easy for employers to give their employees the freedom to access and manage their earnings on their own terms. Thanks to the support of Prosus, Nextalia, and other investors participating in this round, Rain is in a strong position to scale to thousands of new employers and millions of new employees across the U.S.”

Employers who adopt Rain have reported measurable improvements in workforce outcomes, including:

- A 200% increase in job applications.

- Employees working 20 more hours per month on average.

- A 46% reduction in turnover rates after six months.

Rain’s customer base spans a wide range of industries, including healthcare, retail, hospitality, manufacturing, and quick-service restaurants, demonstrating its versatility and widespread appeal.

A Comprehensive Financial Wellness Platform

Rain is more than just an EWA provider—it’s a one-stop-shop for financial wellness and employee engagement. In addition to earned wage access, Rain offers a robust suite of tools designed to improve employees’ financial health, including:

- A deposit account and debit card for seamless financial management.

- An overdraft fee avoider to help workers sidestep costly bank fees.

- A bill reducer to lower recurring expenses.

- A tax filing tool to simplify tax preparation.

- A financial education portal offering resources and guidance.

- 1×1 financial coaching within the app for personalized support.

- An AI-powered financial wellness and job support agent for real-time assistance.

- An off-cycle payments tool for employers to disburse bonuses or emergency funds.

- An employee rewards tool to incentivize performance and engagement.

Later this year, Rain plans to launch innovative savings and credit products, as well as an employer messaging tool, further solidifying its position as a leader in the financial wellness space.

Investor Confidence in Rain’s Vision

Investors have taken notice of Rain’s rapid growth and expanding impact. “The relationship between work and life is evolving, and independent financial flexibility is becoming essential for employees,” said Ali Esfahani, Head of Americas Investments at Prosus. “Rain provides a solution that empowers workers, helps businesses thrive, and plays a fundamental role in this shift in workforce dynamics. We believe in their vision and are excited to be part of this journey as they continue to grow their business.”

Attilio Mazzilli, Co-Head of Nextalia Ventures, echoed this sentiment: “Rain has shown tremendous growth in terms of both acquiring well-known brands as customers and significantly expanding its impact on employees with a continually developing suite of powerful financial wellbeing tools beyond EWA.”

Milestones and Future Growth

Since its launch in 2019, Rain has onboarded over 2.5 million employees and distributed more than $2 billion in earned wages. In March 2023, the company raised $116 million in Series A funding ($66 million equity and $50 million in debt), marking the largest funding round in HR tech history. With this new Series B funding, Rain is well-positioned to accelerate its growth trajectory and bring its transformative solutions to even more workers and employers.

As the modern workplace continues to evolve, Rain’s innovative approach to financial wellness is addressing a pressing need for both employees and employers. By providing workers with the tools they need to manage their finances responsibly and empowering employers to foster a more engaged and productive workforce, Rain is shaping the future of work—one paycheck at a time.

To learn more about how Rain is revolutionizing earned wage access and financial wellness, visit their website or explore their suite of tools today.

About Rain

Rain is the trusted leader in employee-centric financial wellness solutions, serving middle-market and enterprise organizations nationwide. Through a comprehensive suite of offerings, including earned wage access and other financial wellness benefits, Rain seamlessly integrates with any organization’s existing infrastructure, providing the flexibility essential for effective financial management. Rain’s mission is to empower employees to reach financial freedom. At Rain, financial freedom means being able to afford everyday life without stressing about pay dates or pay cycles. Visit www.rainapp.com to learn how to elevate your workforce’s financial well-being with Rain.