RedBird Capital Partners to Acquire Telegraph Media Group: Unlocking a New Era of Growth for Iconic 170-Year-Old Brand

In a landmark deal set to redefine the future of UK media, RedBird Capital Partners, a global leader in sports, media, and entertainment investments, has announced an in-principle agreement to acquire The Telegraph Media Group (TMG) at a valuation of £500 million. This transaction marks the largest investment in UK print media in over a decade and paves the way for a new chapter of growth and innovation for the 170-year-old institution.

A Strategic Vision for Growth

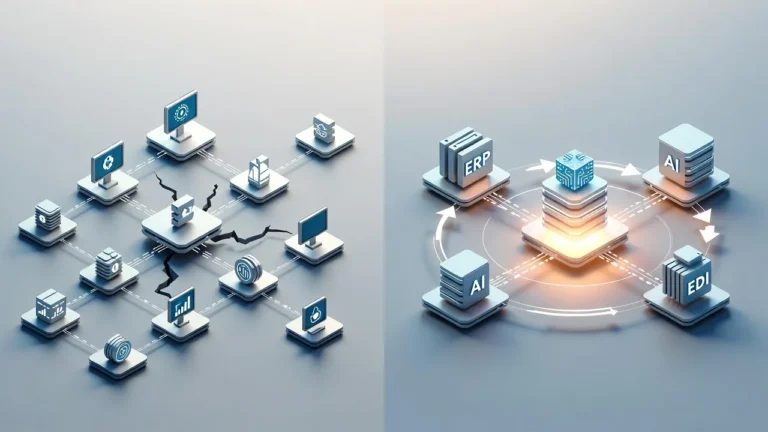

RedBird’s acquisition of TMG signals its commitment to transforming the iconic British publication into a global powerhouse. The investment firm plans to inject capital into TMG’s digital operations, subscriptions, and journalism, focusing on leveraging cutting-edge data analytics and artificial intelligence tools. These innovations will enhance the value proposition for TMG’s core subscriber base while attracting new audiences worldwide.

Under RedBird’s ownership, TMG will expand its international footprint, with a particular emphasis on the United States, where RedBird already boasts a robust presence across news, media, and sports. Collaborating with TMG’s senior leadership, RedBird aims to develop new content verticals, such as travel and events, to capitalize on opportunities presented by a growing international and affluent subscriber base.

“We believe that the UK is a great place to invest, and this acquisition is an important part of RedBird’s growing portfolio of media and entertainment companies in the region,” said Gerry Cardinale, Founder and Managing Partner of RedBird. “Having spent time with Chris Evans, Anna Jones, and the entire senior management team at The Telegraph, we have tremendous conviction in the growth potential of this incredibly important cultural institution.”

Cardinale added, “RedBird has a 30-year track record of partnering with iconic, longstanding brands and supporting their intellectual property for new forms of monetization. We are excited to work with The Telegraph’s exceptional leadership to deliver a growth plan that takes its world-class journalism to new audiences globally.”

Building on a Strong Foundation

Since launching its digital subscription strategy, TMG has made remarkable progress under the leadership of CEO Anna Jones and Editor Chris Evans. The publication has earned numerous accolades, including being named ‘Website of the Year’ at the UK Press Awards for two consecutive years. However, both leaders acknowledge that there is still significant untapped potential.

“The Telegraph has achieved enormous progress in recent years, thanks to the hard work of its brilliant staff,” said Evans. “But with the right plan and investment from ambitious new owners, this venerable title can look forward to an era of unprecedented success.”

Jones echoed this sentiment, stating, “Telegraph Media Group is an award-winning news media organization, with exceptional journalism at its heart, supported by leading commercial expertise and a commitment to innovation. RedBird Capital Partners have exciting growth plans that build on our success and will unlock our full potential across the breadth of our business.”

Expanding Global Reach and Unlocking New Opportunities

A cornerstone of RedBird’s strategy is expanding TMG’s global reach, particularly in the United States. By leveraging TMG’s authoritative reporting and iconic brand, RedBird aims to attract new audiences seeking high-quality, independent journalism. Additionally, RedBird’s extensive portfolio—including stakes in Liverpool FC, All3Media, and Skydance Media—will create unique partnership opportunities to blend tradition with innovation.

RedBird’s growth plans also include investing in top journalistic talent, from award-winning reporters to opinion-leading commentators. The firm will focus on accelerating TMG’s transition to digital, removing barriers to growth, and ensuring the publication remains a leader in quality journalism.

Upholding Editorial Values with Minority Investors

To ensure continuity and uphold TMG’s editorial values, RedBird is in discussions with select UK-based minority investors who possess print media expertise. International Media Investments (IMI) will also participate as a minority investor, subject to secondary legislation regarding foreign ownership thresholds. This collaborative approach underscores RedBird’s commitment to preserving TMG’s legacy while driving future growth.

RedBird’s Impressive Portfolio

Founded in 2014 by Gerry Cardinale, RedBird Capital Partners has established itself as a transformative force in sports, media, and entertainment. Its flagship investments span a wide array of industries, including Premier League champion Liverpool FC, All3Media, Fulwell Entertainment, and Build a Rocket Boy. The firm’s pending acquisition of Channel 5 further solidifies its position as a major player in UK media.

With a global network spanning ten offices and serving blue-chip institutional and family office investors, RedBird specializes in identifying unique, transformative opportunities across sports, media, entertainment, and financial services. Its investments in Arax, Aquarian, and Bishop Street Underwriters highlight its diverse expertise and ability to scale businesses effectively.

A Bright Future for The Telegraph

The acquisition of TMG represents a bold step forward for one of the UK’s most storied publications. By combining RedBird’s financial acumen and strategic vision with TMG’s rich heritage and innovative spirit, this partnership promises to usher in a new era of growth, digital transformation, and global expansion.