SanDisk Announces Pricing of Expanded Secondary Offering of Common Stock

SanDisk Corporation (Nasdaq: SNDK) (“SanDisk” or the “Company”) has announced the pricing of an upsized secondary public offering of its common stock. The offering, which includes 18,534,581 shares of SanDisk’s common stock (the “SNDK Shares”), reflects an increase from the originally proposed 17,000,000 shares. The SNDK Shares are being offered at a public offering price of $38.50 per share. Notably, SanDisk is not selling any shares in this offering and will not receive any proceeds from the sale of the SNDK Shares. Instead, the shares are being sold by Western Digital Corporation (“WDC”), SanDisk’s former parent company.

Debt-for-Equity Exchange Preceding the Offering

Prior to the closing of the offering, WDC is expected to execute a debt-for-equity exchange with affiliates of J.P. Morgan Securities LLC and BofA Securities (collectively referred to as the “debt-for-equity exchange parties”). Under this arrangement, WDC will exchange the SNDK Shares for certain outstanding indebtedness held by these affiliates. Upon completion of the debt-for-equity exchange, WDC will deliver the SNDK Shares to J.P. Morgan Securities LLC and BofA Securities, who are acting as the selling stockholders in the offering. Following this process, the selling stockholders intend to sell the SNDK Shares to the underwriters as part of the secondary offering.

This innovative debt-for-equity exchange highlights WDC’s strategic efforts to reduce its financial obligations while simultaneously facilitating liquidity for its stakeholders. By converting debt into equity and subsequently selling the shares, WDC aims to optimize its capital structure and enhance financial flexibility.

Greenshoe Option Granted to Underwriters

The selling stockholders have granted the underwriters an option, commonly referred to as the “greenshoe,” to purchase up to 2,780,187 additional shares of SanDisk common stock at the public offering price, less the underwriting discount. This option is exercisable for 13 days following the offering. If the greenshoe is exercised in full, WDC’s ownership of SNDK Shares would be reduced to 7,513,019 shares after the completion of the debt-for-equity exchange and the offering.

The inclusion of the greenshoe option provides the underwriters with the ability to stabilize the market price of the SNDK Shares in the early stages of trading. This mechanism is widely used in public offerings to ensure orderly trading and mitigate potential volatility.

Joint Lead Book-Runners and Closing Timeline

J.P. Morgan Securities LLC and BofA Securities are serving as the joint lead book-runners for the offering and are also acting as representatives of the underwriters. Their expertise in managing large-scale transactions underscores the credibility and professionalism of the offering process. The transaction is expected to close on June 9, 2025, subject to customary closing conditions.

Regulatory Compliance and Prospectus Availability

A registration statement on Form S-1, including a prospectus related to the securities, was declared effective by the U.S. Securities and Exchange Commission (SEC) on June 5, 2025. The offering is being conducted exclusively through a prospectus, which provides detailed information about the terms of the offering and the risks associated with investing in SanDisk’s common stock. Investors can access these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov.

Alternatively, copies of the final prospectus, once available, may be obtained directly from J.P. Morgan Securities LLC or BofA Securities. For J.P. Morgan Securities LLC, requests can be directed to c/o Broadridge Financial Solutions at 1155 Long Island Avenue, Edgewood, NY 11717, via email at prospectus-eq_fi@jpmchase.com or postsalemanualrequests@broadridge.com. For BofA Securities, inquiries can be sent to the Prospectus Department at NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001, or via email at dg.prospectus_requests@bofa.com.

Legal Disclaimer

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of these securities in any state or jurisdiction where such an offer, solicitation, or sale would be unlawful prior to registration or qualification under applicable securities laws. Investors are encouraged to carefully review the prospectus and consult with their financial advisors before making any investment decisions.

Strategic Implications for SanDisk and WDC

While SanDisk itself is not raising capital through this offering, the transaction represents a significant step in WDC’s broader strategy to streamline its financial position. By divesting a portion of its stake in SanDisk, WDC reduces its exposure to the company while unlocking value for its creditors and shareholders. For SanDisk, the offering reinforces its status as a publicly traded entity with a robust shareholder base and strong market presence.

The expanded size of the offering—from 17 million to over 18.5 million shares—demonstrates strong investor demand for SanDisk’s common stock. This vote of confidence underscores the company’s continued relevance and growth potential within the technology sector. As SanDisk continues to innovate and expand its product portfolio, the proceeds from this offering indirectly support WDC’s efforts to deleverage and refocus its resources on core business priorities.

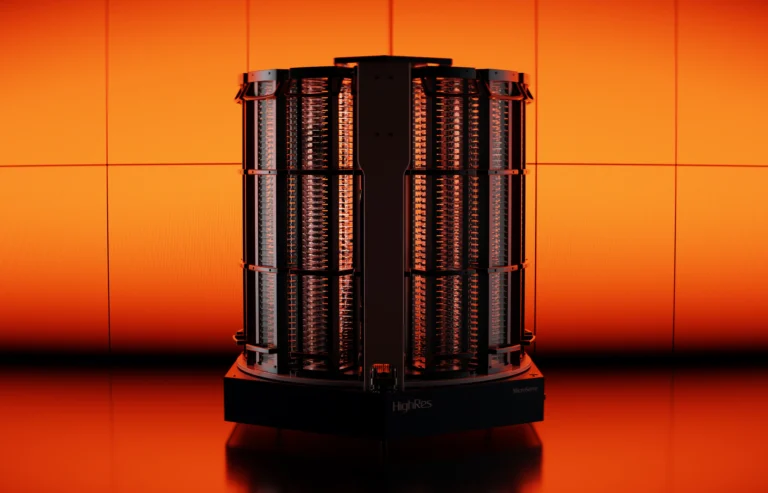

About Sandisk

Sandisk is a leading developer, manufacturer and provider of data storage devices and solutions based on NAND flash technology. With a differentiated innovation engine driving advancements in storage and semiconductor technologies, its broad and ever-expanding portfolio delivers powerful flash storage solutions for everyone from students, gamers and home offices, to the largest enterprises and public clouds to capture, preserve, access and transform an ever-increasing diversity of data. The Company’s solutions include a broad range of solid state drives, embedded products, removable cards, universal serial bus drives, and wafers and components.