Streetbeat Secures $15 Million in Series A to Scale AI Trading Platform for Wealth Managers and Retail Investors

AI-Powered Solutions for Financial Advisors and Retail Investors Drive Impressive Growth

Streetbeat, an innovative AI-powered intelligence platform catering to financial professionals and retail investors, has successfully raised $15 million in Series A funding. This new investment round was led by CDP Venture Capital through the AI Fund, with participation from TTV Capital, Monte Carlo Capital, and 3Lines VC. With this funding, Streetbeat’s total capital raised now stands at $25 million.

The company plans to leverage this financial boost to enhance its AI-powered trading solutions, which have already demonstrated impressive results in automating investment strategies, risk management, and portfolio analysis. By further advancing its AI capabilities, Streetbeat aims to broaden its impact on wealth managers, brokers, and retail investors globally.

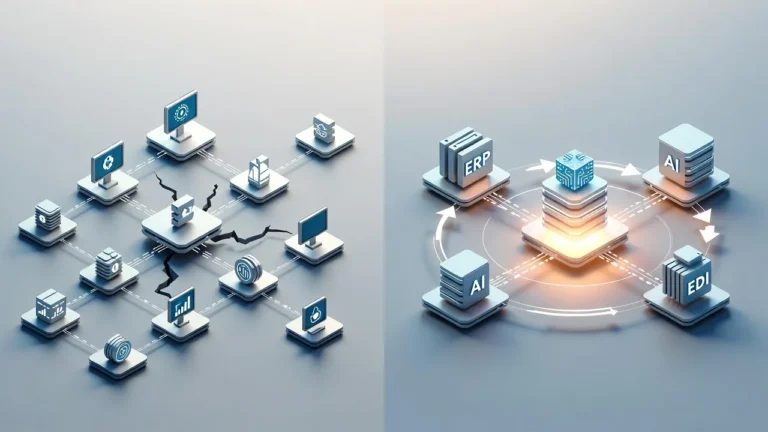

Revolutionizing Wealth Management with AI-Powered Automation

StreetbeatPRO, Streetbeat’s flagship platform, enables wealth managers, financial institutions, and brokerages to integrate off-the-shelf AI agents into their workflows. These agents are designed to automate various tasks, including investment management, risk analysis, and portfolio adjustments. Alternatively, customized agents can be developed to meet the unique needs of each client.

For financial advisors, the impact has been significant. Advisors using StreetbeatPRO have reported up to five times the number of clients they previously serviced, with assets under management (AUM) growing by as much as 15% annually. Currently, 4,000 financial advisors across 15 countries—including recent expansions into Germany, Italy, and South Korea—are using the platform to streamline their advisory processes.

One of Europe’s top brokerage banks, with over $120 billion in AUM, is already utilizing StreetbeatPRO to enhance its advisory services, signaling the increasing demand for AI-driven solutions in wealth management.

AI for Retail Investors: Empowering Personal Finance

Streetbeat has also developed an AI-powered platform designed specifically for retail investors in the U.S. This service enables individual investors to interact with Streetbeat’s AI advisor to create diversified investment portfolios tailored to their time horizon, risk tolerance, and current market conditions. The AI advisor aims to mitigate the common pitfalls of manual trading, where 80% of trades result in losses.

Streetbeat’s AI-driven trading strategies have proven to outperform manual trading, with portfolios managed by Streetbeat showing an annual return of +8%, a substantial improvement over traditional methods. This service is slated for expansion into Europe in 2026, with integration efforts already underway with several European partners.

Proven AI Technology with Unmatched Accuracy

Streetbeat’s proprietary AI technology has been in production for over three years, utilizing real-time data from over 170 data sets. In a benchmark test designed to simulate realistic customer service interactions, Streetbeat’s AI achieved an impressive 94.78% accuracy rate. This level of performance surpasses competitors by 30% while maintaining a cost-efficient approach, with task costs ranging from $0.10 to $0.15 per action.

“We invested in Streetbeat because it combines a visionary approach with a proven, scalable technology. The multi-agent architecture behind Streetbeat’s AI is cutting-edge, and its adoption among financial advisors and institutions is a clear indication of the value it provides,” said Vincenzo Di Nicola, Head of the AI Fund at CDP Venture Capital. “We are excited to support Streetbeat as they continue to expand globally and set new standards in the fintech industry.”

Strategic Vision for Global Expansion

Streetbeat’s CEO, Damián Scavo, emphasized the company’s mission to democratize financial intelligence, making it accessible to both professionals and consumers. “From AI-powered portfolios for retail investors to customized agents that streamline workflows for wealth managers, our solutions are delivering significant returns for our customers. This funding will help us scale internationally and further enhance our AI capabilities,” said Scavo.

The Series A funding will be used to strengthen Streetbeat’s technical teams in both the U.S. and Europe, facilitating product development and accelerating global expansion. The company is already registered as an investment advisor with the SEC and is fully compliant with SOC 2 Type I and Type II standards, ensuring its platform meets the highest levels of security and regulatory requirements.

Strong Backing from Key Investors

Streetbeat has garnered strong support from investors who see the potential for AI to revolutionize the financial services industry. “Damián recognized the massive potential for AI in financial services early on, and the Streetbeat team has worked tirelessly to align their capabilities with market needs,” said Neil Kapur, Partner at TTV Capital. “StreetbeatPRO has seen tremendous traction, especially in Europe, and is poised to become a critical solution for financial professionals and retail investors alike.”

With its innovative solutions, growing customer base, and robust funding, Streetbeat is well-positioned to continue driving the evolution of AI in wealth management and retail investing.