Tadaweb Secures $20 Million to Scale Its Small Data PAI and OSINT Operating System

Tadaweb, a leader in Small Data solutions for publicly available information (PAI) and open-source intelligence (OSINT), has raised $20 million in funding to accelerate its global expansion. The investment, led by Arsenal Growth and Forgepoint Capital International, underscores the growing demand for innovative tools that enhance the efficiency of analysts and investigators in defense, national security, public safety, cyber threat intelligence, and corporate security sectors. With this capital infusion, Tadaweb aims to scale its Small Data Operating System, which is already trusted by organizations across Europe and the U.S., transforming their ability to turn raw data into actionable insights in minutes rather than days.

Revolutionizing PAI and OSINT Analysis

PAI refers to information sourced from public domains, including print media, online platforms, social media, public records, websites, blogs, forums, imagery, and videos. OSINT involves the collection, analysis, and dissemination of this publicly available data to support decision-making. According to industry estimates, OSINT accounts for 80-90% of the information-gathering activities conducted by law enforcement agencies and government entities.

In an era marked by political turmoil, economic instability, and cybersecurity threats, the ability to rapidly analyze PAI is critical for both public and private sector organizations. However, the sheer volume of available data often overwhelms even the most well-resourced teams, making it challenging to extract valuable insights quickly. This is where Tadaweb’s Small Data approach comes into play.

A Human-Centric Approach to Small Data

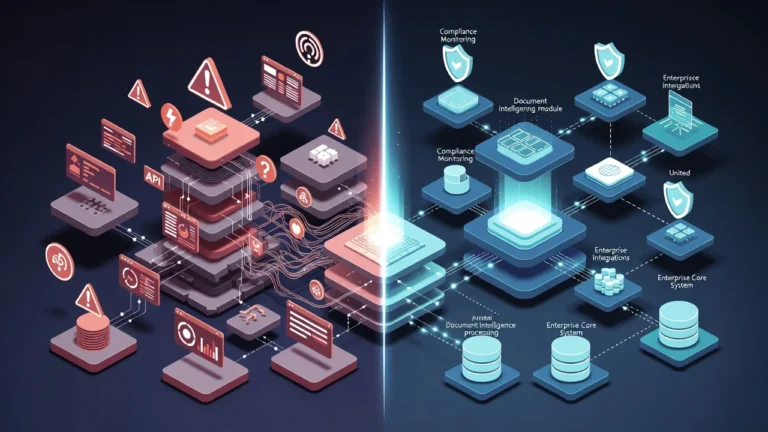

Unlike Big Data solutions that prioritize automation and vast datasets, Tadaweb focuses on Small Data—the manageable amount of information that humans can process effectively. By combining precision data points with AI-augmented tools, Tadaweb empowers human analysts to work smarter, not harder. Its Operating System integrates seamlessly with third-party web tools and APIs, ingesting data from PAI, commercially available sources, and emerging platforms to deliver accurate and actionable insights.

Francois Gaspard, Chief Executive Officer and co-founder of Tadaweb, emphasized the company’s mission: “Our goal is to make the world safer by empowering the human mind with the right information at the right time. While many are turning to AI as a silver bullet, we focus on transparency, not black boxes. We embrace AI but ensure our solution keeps humans in control. True impact comes from putting humans at the center.”

By augmenting analysts’ skills with a Small Data Operating System, Tadaweb reduces investigation times from days to minutes. This human-centric model has earned the trust of users across various expertise levels, enabling them to address mission-critical priorities such as fraud reduction, threat identification, supply chain disruption mitigation, and financial loss prevention. Tadaweb’s clients include government agencies focused on defense, national security, and public safety, as well as private-sector organizations specializing in cyber threat intelligence and corporate security.

Strategic Investment to Fuel Growth

The $20 million funding round was spearheaded by Arsenal Growth and Forgepoint Capital International, with participation from existing investor Wendel. Both Jason Rottenberg, General Partner at Arsenal Growth, and Damien Henault, Managing Director at Forgepoint Capital International, will join Tadaweb’s board. Their involvement reflects confidence in Tadaweb’s vision and its potential to reshape the OSINT landscape.

Jason Rottenberg highlighted Tadaweb’s unique value proposition: “Tadaweb has built a genuinely human-centric Operating System focused on dramatically boosting analyst productivity. The company is uniquely positioned to help customers harness the vast opportunities of OSINT, regardless of their sector focus, with an ambitious team building an extraordinary company.”

Damien Henault added: “Many players claim to assist organizations with OSINT, but they offer fragmented features rather than a fully integrated end-to-end platform. Three things attracted us to Tadaweb: its Small Data approach, its low/no-code visual query engine, and its unwavering commitment to prioritizing the human analyst over the data itself. The hyper-focused management team is dedicated to delivering real value to its customers.”

Scaling for Global Impact

This latest funding round brings Tadaweb’s total investment to $40 million, following an initial $18 million from Wendel in 2023 and $2 million from angel investors in 2015. The new capital will be used to advance product development, recruit top talent, and expand Tadaweb’s go-to-market strategy across public and private sectors worldwide.

As geopolitical tensions rise and digital ecosystems grow increasingly complex, the need for efficient and reliable OSINT tools is more pressing than ever. Tadaweb’s Small Data Operating System addresses this challenge by empowering analysts to cut through the noise and focus on what truly matters. By placing humans at the center of the analytical process, Tadaweb is not only enhancing productivity but also contributing to a safer and more informed world.

Looking ahead, Tadaweb is poised to solidify its position as a leader in the OSINT space. With a robust platform, a clear mission, and strong backing from leading cybersecurity investors, the company is well-equipped to meet the evolving needs of its customers and drive meaningful impact on a global scale. As organizations continue to grapple with information overload, Tadaweb’s innovative approach offers a beacon of clarity and efficiency in an otherwise chaotic digital landscape.

About Tadaweb

Tadaweb delivers an Operating System for PAI and OSINT that augments analysts with a Small Data approach, enabling them to reach new levels of hyper-efficiency and reducing time to insight from days to minutes. Tadaweb’s platform combines technology with human intuition and expertise, focusing on transparency and ethics to reshape how organisations navigate and utilise the digital world. Founded in 2011, the company is headquartered in Luxembourg with offices in Paris and London. For more information, follow Tadaweb on LinkedIn.

About Arsenal Growth

Arsenal Growth Equity invests in growth-stage software and tech-enabled services companies. Arsenal targets businesses with $5 to $20 million in recurring revenues that serve large markets, offer innovative solutions and are led by exceptional teams committed to building enduring value. Arsenal invests in a broad range of sectors serving mission critical functions such as AI-driven platforms, vertical SaaS, supply chain/logistics, healthcare IT, cybersecurity, edtech, national security, and regtech, amongst others. For more information, follow Arsenal Growth on LinkedIn.

About Forgepoint Capital

Forgepoint Capital is a leading venture capital firm that partners with transformative cybersecurity, artificial intelligence, and infrastructure software companies protecting the digital future. With the largest sector-focused investment team, over $1 billion in AUM, and an active portfolio of 40 companies, the firm brings over 100 years of collective company-building expertise and its global Advisory Council of more than 100 industry leaders to support exceptional entrepreneurs advancing innovation globally. Founded in 2015 and headquartered in the San Francisco Bay Area and London with a presence in Madrid and Paris, Forgepoint is proud to help category-defining companies reach their market potential. For more information, follow Forgepoint on LinkedIn.

About Wendel

Wendel is one of Europe’s leading listed investment firms. Regarding its principal investment strategy, the Group invests in companies which are leaders in their field, such as ACAMS, Bureau Veritas, Crisis Prevention Institute, Globeducate, IHS Towers, Scalian, Stahl and Tarkett. In 2023, Wendel initiated a strategic shift into third-party asset management of private assets, alongside its historical principal investment activities. In May 2024, Wendel completed the acquisition of a 51% stake in IK Partners, a major step in the deployment of its strategic expansion in third-party private asset management and also completed in March 2025 the acquisition of 72% of Monroe Capital. As of March 31, 2025, Wendel manages 34 billion euros on behalf of third-party investors, and c.6.3 billion euros invested in its principal investments activity.

Wendel is listed on Eurolist by Euronext Paris.