Transforming Capital Allocation into Production-Ready Infrastructure for the Modern Financial Stack

The era of “AI tourism” in financial services is officially ending, replaced by a rigorous demand for operational utility and measurable ROI. Uptiq, an AI platform purpose-built for the financial sector, has secured $25 million in Series B funding to accelerate this transition from theoretical pilots to deployed production systems. Led by Curql, with participation from strategic heavyweights like Silverton Partners, 645 Ventures, and Broadridge, this capital injection signals a maturing market where institutions are no longer satisfied with mere demos; they require resilient infrastructure capable of navigating complex regulatory environments.

Financial institutions today face a paradox: they possess the capital and desire to adopt Generative AI, yet they remain hamstrung by fragmented legacy systems and strict compliance mandates. Uptiq addresses this friction by bypassing the “wrapper” approach common in horizontal AI tools. Instead, the company delivers a vertical-specific orchestration layer designed to integrate deeply with core banking systems. By focusing on “industry-ready” solutions, Uptiq is positioning itself not just as a software vendor, but as the foundational architecture for the next generation of automated financial services.

Key Insights at a Glance

- Strategic Capital Injection: The $25 million Series B round is led by Curql, emphasizing support from credit unions and financial institutions rather than just pure venture capital.

- The “Qore” of the Matter: The funding accelerates the launch of Qore, an orchestration platform that allows developers to build compliant financial AI applications without assembling fragmented stacks.

- Proven ROI Metrics: Current deployments demonstrate significant efficiency gains, including 41% faster underwriting decisions and a 29% reduction in operational costs.

- Ecosystem Expansion: Uptiq is evolving from a closed solution provider to an open platform, enabling fintechs and internal bank teams to prototype and deploy digital workers in days.

Bridging the Gap Between Hype and Auditability

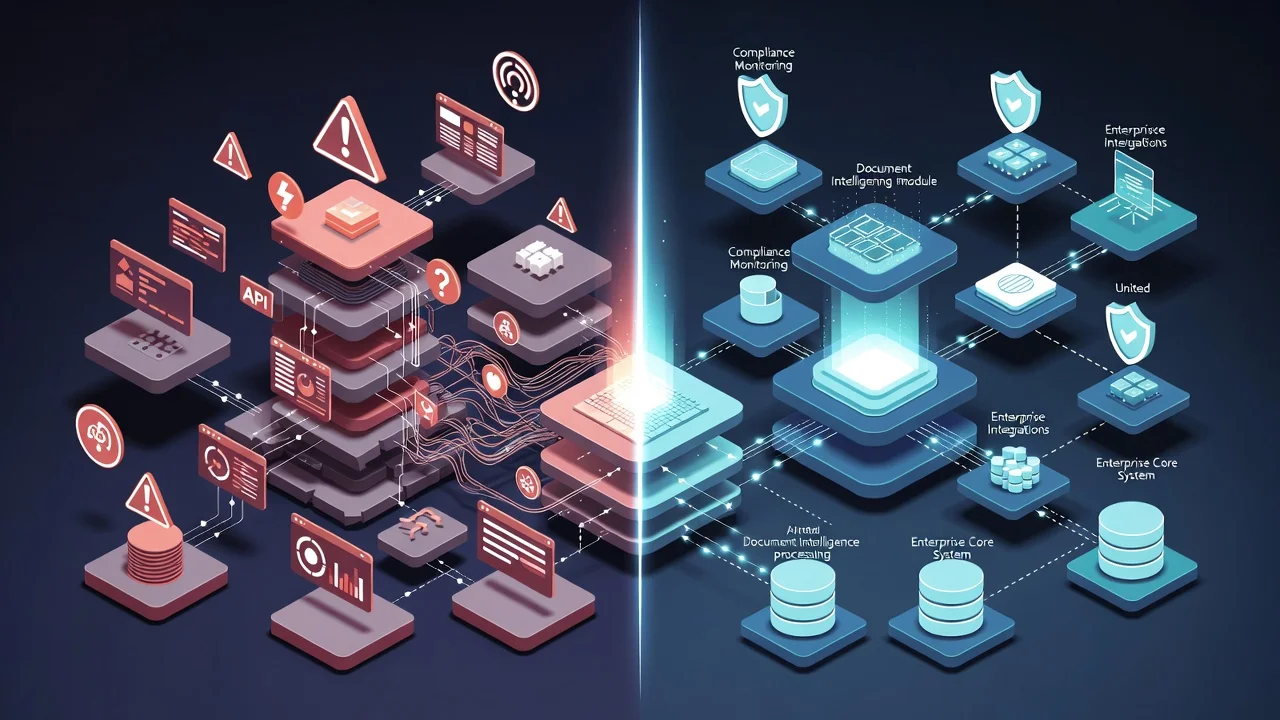

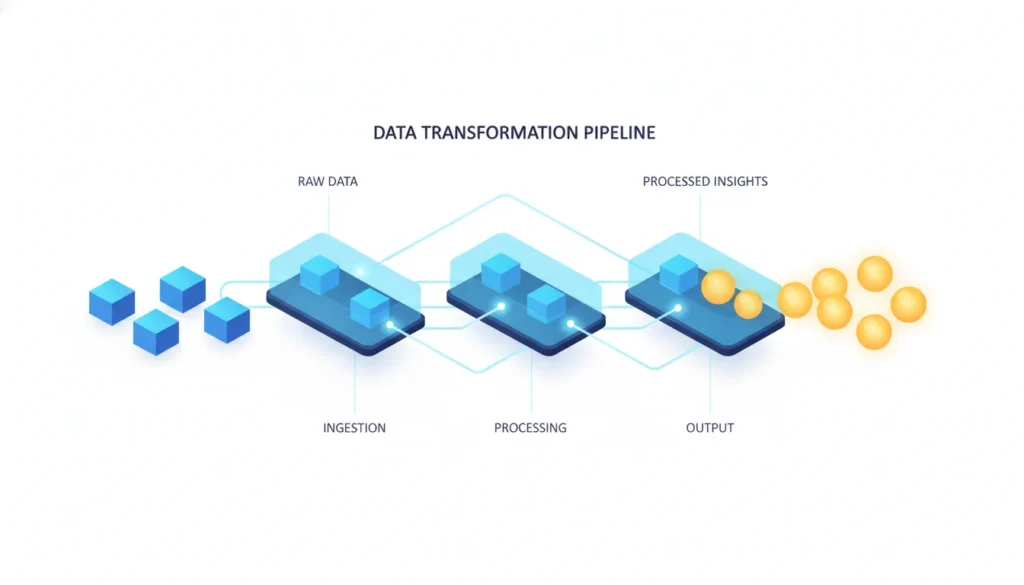

The primary agitation in the current fintech landscape is the inability to scale AI experiments. Most horizontal Large Language Models (LLMs) lack the domain specificity required for tasks like commercial lending analysis or covenant monitoring. Building AI in a highly regulated environment without a dedicated orchestration layer is like trying to build a skyscraper on a foundation of sand—structurally unsound and destined to fail inspection. Uptiq eliminates this structural weakness by providing pre-packaged, production-ready applications that handle document processing, financial reasoning, and permissions out of the box.

But how do institutions bridge the chasm between experimental chat interfaces and compliant, audit-ready workflows? The answer lies in specialized infrastructure. Uptiq’s solutions for banking, wealth management, and embedded finance are engineered to meet enterprise-grade security standards immediately. By automating high-friction processes—such as banker co-pilots for onboarding or AI-driven risk analysis—Uptiq allows institutions to process double the volume of loan applications without increasing headcount, a critical capability in a high-interest-rate environment where operational efficiency protects margins.

Unleashing Builders with the Qore Platform

Perhaps the most significant development in this funding round is the strategic expansion of Qore. Originally the internal engine powering Uptiq’s solutions, Qore is now opening as a self-serve platform for the broader developer economy. This move democratizes access to sophisticated financial AI tools, allowing independent developers, fintech startups, and internal bank engineering teams to leverage multi-agent workflows and deep financial libraries.

Operationalizing the Developer Experience

Qore solves the “cold start” problem for financial AI development. Instead of rebuilding compliance layers or integration pipes from scratch, builders can use natural language prompts to deploy applications that already understand financial contexts. This shift aligns with the vision of investors like Nnamdi Okike of 645 Ventures, who notes that the industry is at an inflection point where technology must align with operational realities. By providing the “plumbing” for financial intelligence, Uptiq is enabling a new category of applications that are secure by design and capable of handling over $1 billion in transactions, as evidenced by their current client base of over 140 institutions.

The Future of Regulated AI

As financial services continue to digitize, the distinction between “tech company” and “bank” will blur further, necessitating infrastructure that supports this convergence. Uptiq’s Series B is more than a fundraising milestone; it is a validation of the thesis that vertical AI will outperform horizontal generalists in complex industries. By empowering builders with Qore and delivering tangible efficiency to enterprises, Uptiq is establishing the governance and operational standards that will define the future of automated finance.

About Uptiq

Uptiq is the AI platform for financial services, enabling banks, credit unions, wealth managers, and fintechs to deploy intelligent applications and AI agents across lending, wealth, compliance, and operations. Built with deep domain expertise, enterprise-grade security, and full auditability, Uptiq helps organizations move from AI experimentation to real-world impact.

About Curql

Curql is a strategic venture investment fund backed by a consortium of leading credit unions and financial institutions. The firm focuses on investing in fintech and financial infrastructure companies that enable innovation across banking, lending, payments, and digital financial services. Curql combines capital with industry expertise, providing portfolio companies with access to a network of financial institutions, distribution channels, and strategic partnerships. The fund is managed by experienced financial services and venture capital professionals and is affiliated with credit union-focused technology and innovation initiatives. Through its investments, Curql aims to accelerate the adoption of modern financial technologies across the credit union and broader financial services ecosystem. Learn more at https://curql.com/

About 645 Ventures

645 Ventures is a venture capital firm that partners with exceptional founders building iconic companies. The firm invests at the Pre-Seed, Seed, Series A, and growth stages across fintech, consumer, healthtech, enterprise, cybersecurity, infrastructure/developer tools and deep tech. 645 Ventures supports founders through its resource-intensive approach encompassing hiring, customer introductions and growth strategy, leveraging its proprietary software platform Voyager and deep Connected Network. 645 Ventures manages over $550M in AUM across five funds with investments in industry leaders including Goldbelly, Iterable, Overtime, Resident (acq. By Ashley Home, Inc.), Setpoint, ShopCircle and Shift5. Learn more at www.645ventures.com.

About Silverton Partners

Silverton Partners is an Austin-based venture capital firm that invests in early-stage technology companies across enterprise software, fintech, cloud infrastructure, and data platforms. The firm focuses on partnering with founders building scalable, high-growth businesses and provides hands-on support across product, go-to-market, and company-building. Silverton has invested in a wide range of software and technology-driven companies across the United States, with a strong presence in the Texas and broader U.S. tech ecosystem. The firm is led by experienced venture investors with backgrounds in technology, entrepreneurship, and enterprise markets. Through its investments, Silverton Partners aims to help companies scale from early product-market fit to category leadership. Learn more at https://www.silvertonpartners.com/