Wealth.com and eMoney Partner to Revolutionize AI-Powered Estate and Financial Planning for Advisors

In a groundbreaking move designed to streamline estate and financial planning, Wealth.com, the leading digital estate planning platform for financial advisors, has announced a strategic integration with eMoney Advisor. This collaboration aims to empower financial advisors by offering a unified, tech-enabled experience that eliminates inefficiencies and enhances client outcomes. By leveraging AI-powered tools and real-time data synchronization, this integration positions Wealth.com and eMoney at the forefront of innovation in wealth management.

Empowering Advisors with Seamless Integration

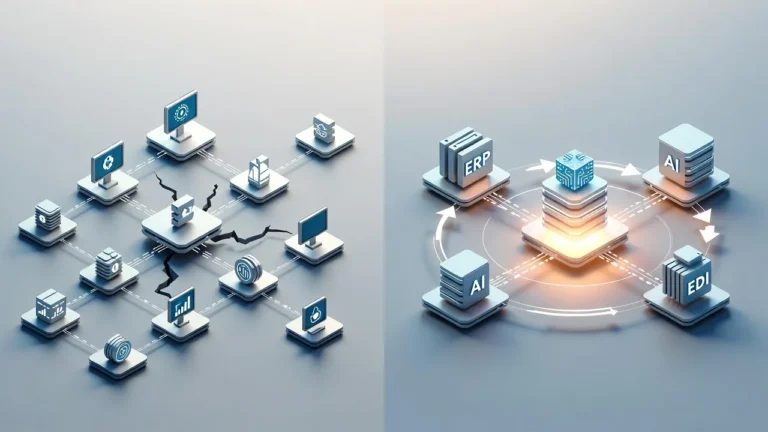

For years, financial advisors have grappled with fragmented tools and time-consuming manual processes that hinder their ability to provide timely and accurate estate planning advice. Recognizing this challenge, Wealth.com and eMoney have joined forces to deliver a solution that transforms the way advisors approach estate and financial planning.

“Our integration with eMoney eliminates the friction that has long plagued wealth managers,” said Danny Lohrfink, co-founder and chief product officer at Wealth.com. “By automating workflows and ensuring real-time data synchronization, advisors can now focus on delivering exceptional value to their clients rather than getting bogged down by administrative tasks.”

This integration, available starting this month, enables advisors to seamlessly incorporate eMoney’s financial data into the Wealth.com platform. The result is a streamlined, AI-driven wealth management experience that prioritizes accuracy, efficiency, and client engagement.

Key Benefits for Advisors and Clients

The Wealth.com and eMoney integration offers several key advantages that will revolutionize how advisors serve their clients:

1. Eliminate Duplicative Data Entry

One of the most significant pain points for advisors has been the need to manually input data across multiple platforms. This integration eliminates redundant data entry, freeing up valuable time for advisors to focus on high-value tasks such as strategy development and client interaction.

2. Ensure Data Consistency and Integrity

Manual processes are prone to errors, which can lead to costly mistakes in estate and financial planning. With real-time synchronization of key financial data, advisors can ensure consistency and accuracy, operating from a single source of truth. This not only minimizes risk but also builds trust with clients who rely on precise and reliable advice.

3. Deliver a Unified Planning Experience

From initial financial projections to final legacy documents, advisors can now guide clients through a cohesive, tech-enabled journey. This unified approach fosters deeper client engagement and strengthens relationships by providing clarity and transparency throughout the planning process.

Meeting Growing Demand for Holistic Planning

In today’s volatile market environment, firms are increasingly turning to holistic planning as a way to deliver value beyond traditional portfolio performance. Estate and legacy planning have emerged as essential components of this approach, helping advisors build long-term client trust and retention.

“Holistic planning is no longer optional—it’s a necessity,” said Luke White, group product manager at eMoney. “Our partnership with Wealth.com underscores our commitment to streamlining the financial planning process and equipping advisors with the tools they need to meet diverse client needs. Together, we’re enabling advisors to strengthen client relationships through accessible, automated, and efficient estate planning.”

This integration comes at a critical time when clients are seeking stability and clarity in an uncertain economic climate. By combining the strengths of Wealth.com and eMoney, advisors can offer comprehensive solutions that address both short-term challenges and long-term goals.

Wealth.com: A Leader in Digital Estate Planning

As the preferred estate planning platform for over 800 wealth management firms, Wealth.com continues to expand its capabilities to meet the evolving demands of advisors and their clients. In addition to this strategic integration, Wealth.com recently launched its innovative Scenario Builder tool—a first-of-its-kind estate planning modeling solution. This tool provides advisors, wealth planners, and estate attorneys with actionable insights into the potential impacts of various strategies on a client’s estate.

These advancements highlight Wealth.com’s dedication to staying ahead of industry trends and delivering cutting-edge solutions that enhance the advisor-client experience. With AI-powered tools and seamless integrations, Wealth.com is setting a new standard for estate planning platforms.

Why This Partnership Matters for the Future of Wealth Management

The collaboration between Wealth.com and eMoney represents a pivotal moment in the evolution of wealth management technology. As client expectations continue to rise, advisors must adopt tools that enable them to deliver personalized, forward-thinking solutions. This integration not only addresses current pain points but also anticipates future needs, positioning advisors to thrive in an increasingly competitive landscape.

For advisors, the benefits are clear: reduced administrative burdens, improved accuracy, and enhanced client engagement. For clients, the result is a more transparent, trustworthy, and efficient planning process that aligns with their unique goals and circumstances.

Building Stronger Client Relationships

With this integration, Wealth.com and eMoney are paving the way for a new era of estate and financial planning. By combining advanced technology with a client-centric approach, advisors can now offer unparalleled value to their clients while driving business growth.

To learn more about how Wealth.com’s end-to-end estate planning platform can transform your practice, visit Wealth.com. Whether you’re looking to streamline workflows, enhance data accuracy, or deepen client relationships, this partnership ensures you’re equipped to succeed in today’s dynamic financial landscape.